The vibrant trade momentum seen in the final months of 2025 is sending positive signals for Vietnam’s export performance in 2026, marking the beginning of a phase of selective yet steady recovery. Free trade agreements (FTAs) are once again proving to be an effective lever for expanding market access and enhancing growth across multiple sectors.

Stable orders signal confidence

At Phuc Sinh Group, one of Vietnam’s leading agricultural exporters, business results in December 2025 were the strongest on record. General Director Phan Minh Thong happily said that in December alone, the agricultural export turnover reached nearly US$50 million, the highest ever.

For the full year, the company’s export value totaled about US$460 million. Looking ahead, Phuc Sinh expects revenue to increase by roughly 27 percent in 2026, supported by stable and diversified orders. Director Phan Minh Thong said that among the 120 countries the company exports to, pepper mainly goes to the Americas, coffee to Europe, while the Middle East prioritizes Halal-certified products. This diversification helps the firm avoid overreliance on any single market and raises the value of each order.

Other major exporters are also seeing signs of recovery. At Bidrico, General Director Nguyen Dang Hien said the beverage company began 2025 with export orders to Japan for fruit juices, bird’s nest and white fungus drinks, and salted lemon beverages. “Early orders helped us maintain a steady production rhythm and reinforced Japanese partners’ confidence in our product lines. We expect continued growth throughout 2026,” he shared.

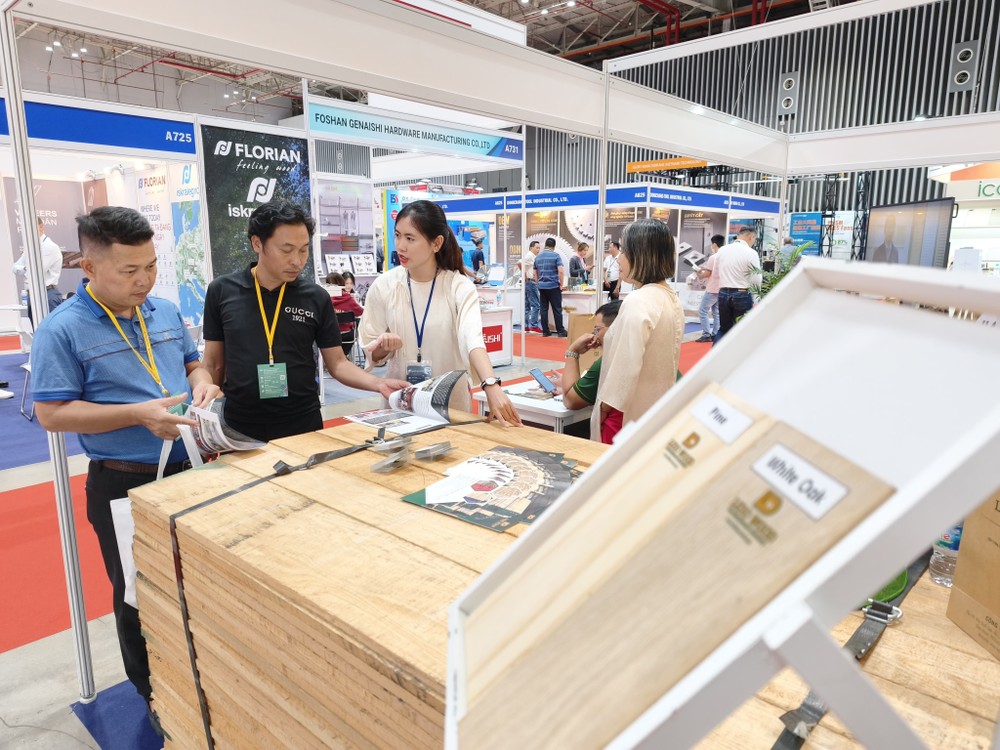

Meanwhile, the wood processing industry is showing renewed resilience. According to Nguyen Liem, Chairman of the Binh Duong Furniture Association (BIFA), Vietnam’s wood products are now exported to more than 160 countries and territories. “The return of large orders under strict quality standards shows that Vietnamese manufacturers are becoming more adaptive and competitive,” he noted.

New opportunities from expanding markets

Beyond traditional destinations, new opportunities are emerging from markets linked to FTAs and high-standard trade frameworks. One standout is the Halal market estimated at over US$2 trillion globally.

Tran Phu Lu, Director of the Ho Chi Minh City Trade and Investment Promotion Center said that the Halal market is not limited to Muslim countries; it’s also expanding strongly in Europe and the United States, where regulations are becoming increasingly stringent.

Ly Kim Chi, President of the Ho Chi Minh City Food and Beverage Association, added that Halal buyers now demand full-chain control from raw materials and production to logistics. “This is not only a challenge, but also a chance for Vietnamese firms to build value-added supply chains and establish long-term credibility,” she emphasized.

Reports from Vietnamese trade offices abroad also point to continued positive signals. In the Nordic region, importers are seeking Vietnamese partners to produce confectionery and processed foods under private labels, with a focus on long-term cooperation and strict compliance with EU food safety standards. In the U.S., demand for consumer goods and light industrial products remains stable, with growing attention to traceability and sustainability.

Fruit and vegetable exports reach nearly US$9 billion in 2025

Vietnam’s agricultural sector also ended 2025 on a strong note. Preliminary data from the Ministry of Agriculture and Environment shows fruit and vegetable exports in December reached nearly US$800 million, up 50 percent year-on-year and 13 percent higher than the previous month.

For the full year, total fruit and vegetable exports are estimated at US$8.7 billion, up 20 percent from 2024. China remains the largest market, accounting for over US$5 billion in export value, a 15 percent increase despite a slight decline in market share. Encouragingly, exports to other markets are rising faster; for instance, the U.S. reached US$500 million, up 56 percent and the EU approximated US$400 million, up 50 percent.

Economic experts say that entering 2026, Vietnam’s exports are positioned for “selective recovery”, driven by FTAs and stronger competitiveness in key sectors such as agriculture, processed food, seafood, textiles, footwear, and wood. The early rebound in orders and a shift toward long-term and standards-based partnerships are enabling businesses to plan production more confidently and sustain growth from the start of the year.