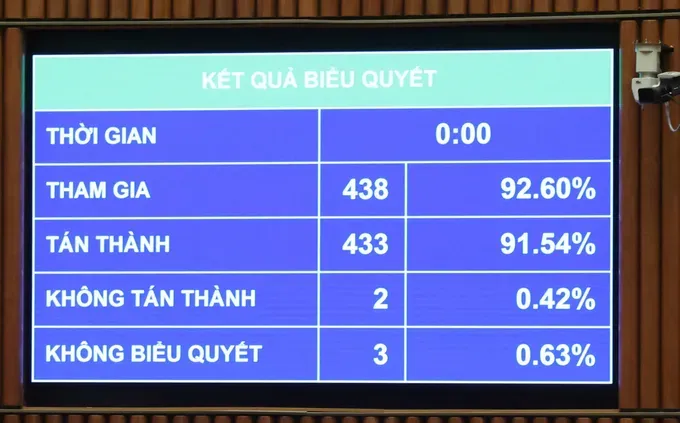

The resolution was supported by 433 out of 438 deputies present, accounting for 91.54 percent of the total National Assembly members.

The most prominent and groundbreaking provisions approved by the National Assembly focus on three key mechanisms, including transit-oriented development (TOD), the establishment of a Free Trade Zone (FTZ), and policies to attract skilled personnel, officials, and civil servants.

Creating a solid framework for urban development

The resolution allows Ho Chi Minh City to retain 100 percent of revenues generated from land use in transit-oriented development (TOD) areas, to be fully allocated for TOD development projects, including urban railway lines and other transportation initiatives.

This mechanism applies to areas adjacent to railway stations, train maintenance and repair depots, and surrounding zones near transport hubs along Ring Road 3.

Ho Chi Minh City is also permitted to use local budgets to independently implement investment projects for compensation, support, and resettlement related to transportation, urban redevelopment, and city development projects.

The city’s master plan, once approved, will serve as the legal basis for implementing detailed urban and rural planning. Ho Chi Minh City authorities are granted the authority to adjust construction plans, if necessary, to serve the public interest and ensure the coherence of the infrastructure system. Construction projects within TOD areas must meet technical infrastructure, social infrastructure, and environmental safety standards for surrounding residential communities.

Free Trade Zone envisioned as highly competitive international platform

According to the resolution, the Free Trade Zone (FTZ) is a geographically defined area established to pilot special and advanced legal mechanisms and policies. Its main functions include manufacturing zones, ports and port logistics areas, logistics centers, and trade-service hubs. The FTZ will be closely linked to Cat Lai and Cai Mep Ha ports.

Infrastructure construction and business projects within the FTZ are exempt from corporate income tax for four years and enjoy a 50 percent reduction for the following nine years. For manufacturing projects, corporate income tax is reduced by 50 percent during the first nine years, with a four-year exemption followed by a 50 percent reduction for the subsequent nine years.

Imports and exports within the Free Trade Zone (FTZ) will be exempt from specialized inspections, provided they meet international management standards, and will not be subject to foreign trade controls or quarantine measures.

For projects classified as strategic investments, the approval process for investment policy and the issuance of Investment Registration Certificates will be shortened to no more than seven working days from the date of receiving a complete and valid application.

Notably, a special foreign exchange management policy will be applied, facilitating transactions for foreign-invested enterprises and import-export businesses, thereby enhancing the attractiveness of the FTZ.

Attracting talent and strategic investors

The resolution also provides mechanisms to attract high-quality resources, both in terms of capital and human talent.

Accordingly, Ho Chi Minh City is authorized to decide on additional supplementary income for officials, public servants, and employees within the state-managed sector. The total supplementary income is capped at no more than 1.8 times the basic salary, excluding specific allowances.

Regarding projects prioritized for investment attraction, the listed sectors include high technology, smart manufacturing, financial centers, and large-scale trade and service operations. The minimum capital requirements for strategic investors in each sector are also clearly defined. For example, infrastructure construction and business projects within functional areas of the Free Trade Zone must have a capital scale of at least VND30 trillion (US$1.14 billion).

Ho Chi Minh City has the autonomy to select strategic investors based on principles of transparency and openness, evaluating criteria such as capital, expertise, experience, and technological commitments.

Earlier, in the report on feedback and revisions to the draft resolution, the Government stated that it had conducted a review to ensure the resolution complies with the Constitution and international treaties to which Vietnam is a party.

The special mechanisms and policies will only be applied when necessary, in accordance with general legal regulations, and solely to address difficulties and obstacles encountered during the development process.

Regarding the attraction of strategic investors, in response to feedback calling for a review and adjustment of minimum investment capital requirements and a shortening of related administrative procedures, the Government has revised and supplemented the capital criteria. It affirmed that Ho Chi Minh City has the authority to review and select strategic investors based on principles of transparency and openness.

The Government has also specified the timeline for procedures, reducing the approval period for investment policy and the issuance of Investment Registration Certificates to seven working days from the date of receiving a complete and valid application.

According to Minister of Finance Nguyen Van Thang, following implementation, the Government will conduct preliminary and comprehensive evaluations. Policies that have been piloted and proven effective will be recommended by the Government to the National Assembly for nationwide application.