“The Seagate focuses on mitigating these external challenges through ongoing expense discipline, new pricing strategies and operational efficiencies; and are also continuing to execute our strong product roadmap to address customer demand for cost-efficient, mass capacity solutions. In the March quarter, we began the volume ramp of our 20-plus terabyte products, which, combined with continued healthy cloud demand, support our outlook for double-digit fiscal year revenue growth."

The company generated US$460 million in cash flow from operations and US$363 million in free cash flow during the fiscal third quarter of 2022. The Seagate’s balance sheet remains healthy, and during the fiscal third quarter, the company paid cash dividends of US$154 million, repurchased 4.2 million ordinary shares for US$417 million and repaid US$220 million to retire the 2022 Senior Notes. Cash and cash equivalents totaled US$1.1 billion. There were 216 million ordinary shares issued and outstanding at the end of the quarter.

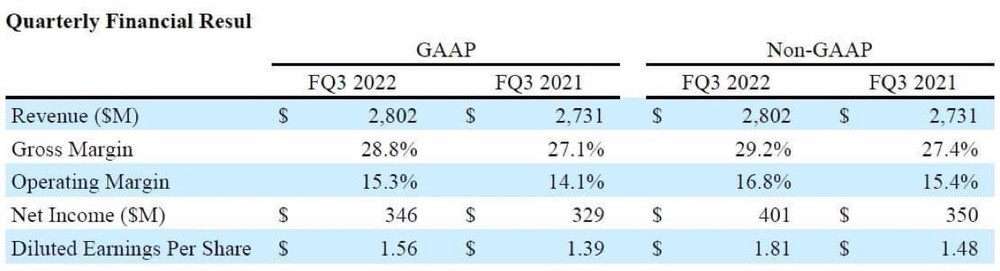

For a detailed reconciliation of GAAP to non-GAAP results, let's see accompanying financial tables. Seagate has issued a supplemental financial information document, which is available on Seagate’s Investor Relations website at investors.seagate.com.

)