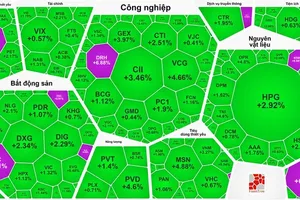

The green color dominates the market after the US Federal Reserve decided to raise interest rate the third consecutive time.

The green color dominates the market after the US Federal Reserve decided to raise interest rate the third consecutive time.

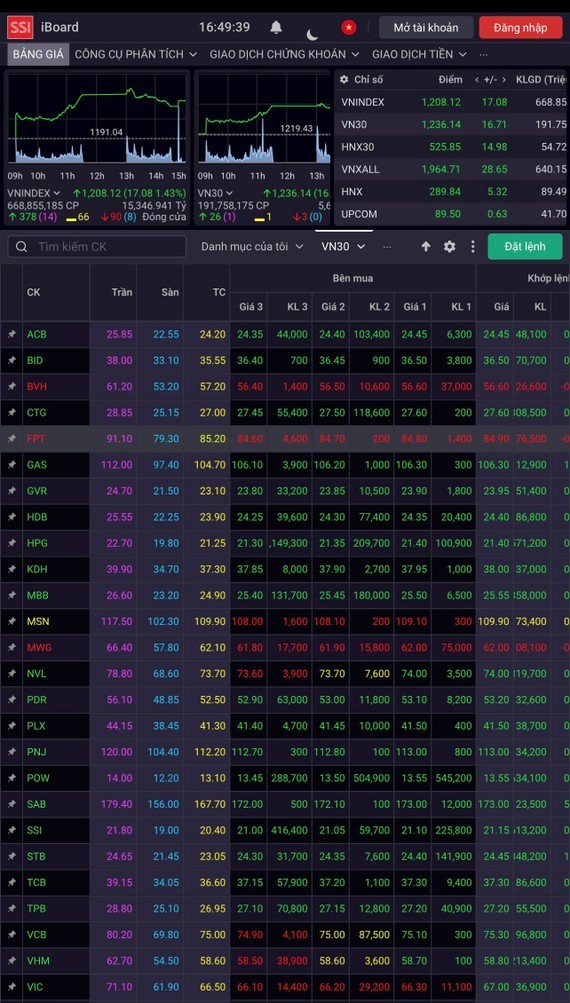

Liquidity improved significantly because the cash flow poured into the market, causing the VN-Index to jump strongly at the beginning of the trading session, quickly regaining the 1,200-point mark after being challenged for a month around this mark. Closing the morning trading session, the VN-Index rallied by nearly 20 points. However, in the afternoon trading session, the market faced profit-taking pressure, causing the VN-Index to cool down slightly at the end of the trading session.

The strong increase in the cash flow made many stock groups, such as banking, securities, real estate, oil and gas, textiles, and steel, simultaneously advance. Among these, many banking stocks rose robustly, making positive contributions to the market, such as STB with an increase of 6.1 percent, MBB with 2.61 percent, BIDV with 2.7 percent, VPB with 2.5 percent, and CTG with 2.2 percent. In addition, industrial park real estate stocks also posted positive gains. Specifically, SZC hit the ceiling, IDC strengthened by 5.59 percent, KBC surged by 4.13 percent, and BCM enhanced by 4.96 percent.

However, some other stocks, such as BVH dropping by 1 percent, DBC hitting the floor, and FPT declining by nearly 2 percent, negatively impacted the VN-Index, sending it down slightly by nearly 2 points compared to the highest level in the trading session.

Closing the trading session, the VN-Index added up 17.08 points, or 1.43 percent, to 1,208.12 points, with 378 winners, 90 losers, and 66 unchanged stocks. Meanwhile, the HNX-Index increased 5.32 points, or 1.87 percent, to close at 289.64 points, with 167 stocks advancing, 47 declining, and 44 standing still.

Market liquidity improved significantly by 76 percent compared to the previous trading session, with a total trading value of VND16.43 trillion. In this session, foreign investors net bought about VND680 billion on the HoSE.

The strong increase in the cash flow made many stock groups, such as banking, securities, real estate, oil and gas, textiles, and steel, simultaneously advance. Among these, many banking stocks rose robustly, making positive contributions to the market, such as STB with an increase of 6.1 percent, MBB with 2.61 percent, BIDV with 2.7 percent, VPB with 2.5 percent, and CTG with 2.2 percent. In addition, industrial park real estate stocks also posted positive gains. Specifically, SZC hit the ceiling, IDC strengthened by 5.59 percent, KBC surged by 4.13 percent, and BCM enhanced by 4.96 percent.

However, some other stocks, such as BVH dropping by 1 percent, DBC hitting the floor, and FPT declining by nearly 2 percent, negatively impacted the VN-Index, sending it down slightly by nearly 2 points compared to the highest level in the trading session.

Closing the trading session, the VN-Index added up 17.08 points, or 1.43 percent, to 1,208.12 points, with 378 winners, 90 losers, and 66 unchanged stocks. Meanwhile, the HNX-Index increased 5.32 points, or 1.87 percent, to close at 289.64 points, with 167 stocks advancing, 47 declining, and 44 standing still.

Market liquidity improved significantly by 76 percent compared to the previous trading session, with a total trading value of VND16.43 trillion. In this session, foreign investors net bought about VND680 billion on the HoSE.