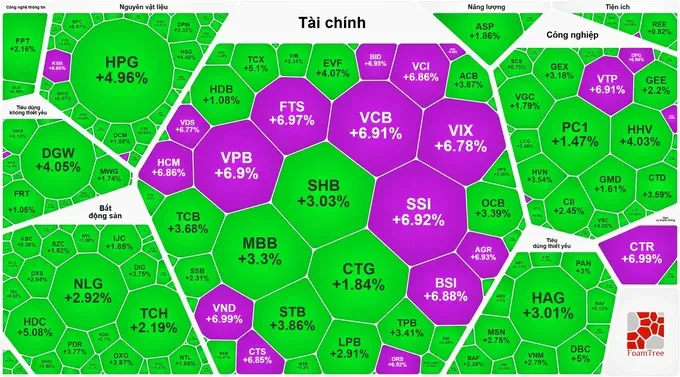

Vietnam’s stock market saw an explosive rally on January 12, with strong gains across nearly all sectors. The trading board was dominated by blue and purple which are colors signaling rising and ceiling-price stocks.

The financial group, including banking and securities stocks, led the surge. Many stocks hit their daily ceiling limits such as VPB, VCB, BID in banking, and SSI, VIX, HCM, SHS, VND, FTS, BSI, CTS, VDS, AGR, ORS in securities.

In the real estate sector, except for the three Vingroup stocks that fell sharply, most others gained: CEO rose 7.07 percent, HDC 5.06 percent, DXG 3.87 percent, PDR 3.77 percent, NLG 2.92 percent, and TCH 2.19 percent.

Steel and consumer stocks also performed strongly. Notable gainers included NKG up 5.07 percent, HPG up 4.96 percent, HSG up 4.49 percent; DGW up 4.05 percent, VNM up 2.79 percent, MSN up 2.75 percent, and BAF up 2.28 percent.

In contrast, the energy sector (power and oil & gas) saw profit-taking pressure after recent rallies, resulting in mild declines; for instance, PVD fell 3.73 percent, POW 1.74 percent, PVS 1.91 percent, PVT 2.96 percent, and PLX 1.4 percent.

At the end of the session, the VN-Index rose 9.43 points (0.5 percent) to close at 1,877.33 points, with 240 stocks gaining, 41 losing, and 52 unchanged. On the Hanoi Exchange, the HNX-Index also advanced by 4.78 points (1.93 percent) to 251.88 points, with 100 gainers, 64 decliners, and 52 unchanged.

Liquidity continued to climb sharply, with total trading value on HOSE reaching nearly VND41.7 trillion (about US$1.58 billion), up VND2.5 trillion from the previous session. Including the HNX, total market turnover exceeded VND44 trillion (around US$1.67 billion).

Foreign investors remained net buyers for the second consecutive session on HOSE, with a total net inflow of nearly VND467 billion. The top three most-purchased stocks were all large-cap blue chips including VCB (over VND420 billion), VPB (over VND270 billion), and HPG (over VND177 billion).