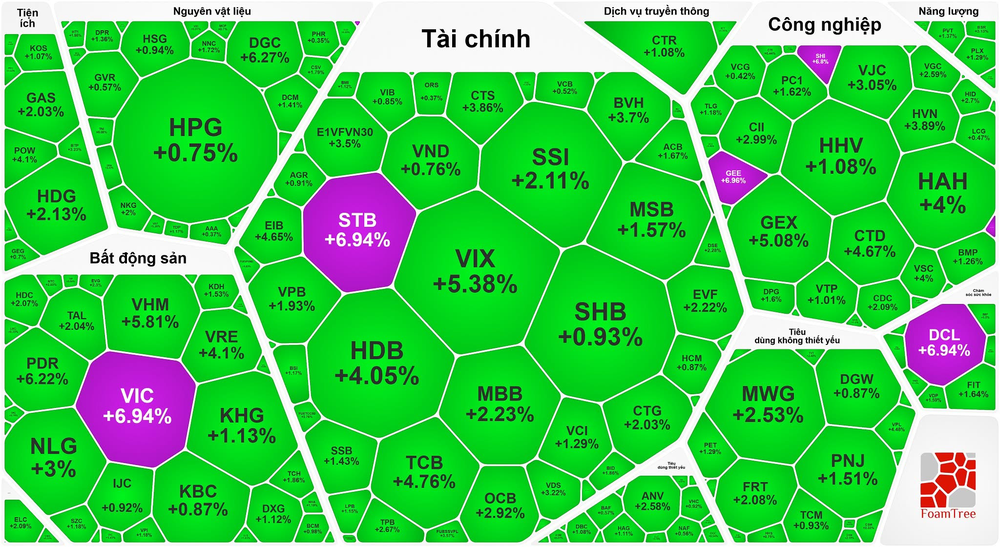

The VN-Index’s rally was driven largely by blue-chip stocks, particularly the Vingroup quartet. VIC hit the ceiling, while VHM jumped 5.8 percent, VPL gained 4.2 percent, and VRE rose 4.1 percent. Together, these four stocks contributed roughly 25 points to the benchmark index.

Banking shares also posted broad-based gains, providing further impetus to the market’s advance. STB climbed to its upper limit, HDB strengthened 4.05 percent, TCB escalated 4.76 percent, EIB increased 4.65 percent, CTG advanced 2.03 percent, and OCB added 2.92 percent.

Securities stocks performed strongly as well, with VIX soaring 5.38 percent, CTS rising 3.86 percent, VDS gaining 3.22 percent, VCI rallying 1.29 percent, and BSI edging up 1.17 percent.

The real estate sector leaned decisively into positive territory. Beyond the Vingroup names, several other property developers recorded solid gains, including PDR, which surged 6.22 percent, HDC grew 2.07 percent, KDH increased 1.53 percent, and KDC expanded 1.53 percent.

Outside the main sectors, consumer and industrial materials stocks traded actively, with several names, such as GEE and SHI, hitting their ceiling prices.

At the close, the VN-Index jumped 46.72 points, or 2.74 percent, to 1,751.03 points. Market breadth was firmly positive, with 216 gainers, 97 losers, and 65 unchanged stocks. On the Hanoi Stock Exchange, the HNX-Index rose 3.26 points, or 1.28 percent, to 257.23 points, with 88 stocks advancing, 50 declining, and 63 standing still.

Liquidity improved markedly. Trading value on the HoSE reached nearly VND30.7 trillion, up about VND6.5 trillion from the previous session. Including the HNX, total market turnover approached VND32.1 trillion.

Foreign investors returned as net sellers on the HoSE, with net selling valued at nearly VND239 billion. Nevertheless, MWG, GEX, and VIX recorded the strongest net foreign buying, at approximately VND193 billion, more than VND130 billion, and nearly VND92 billion, respectively.