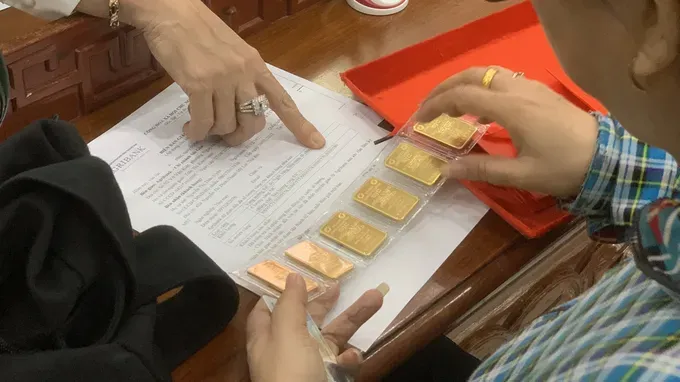

This afternoon, major gold traders in Vietnam simultaneously raised buying prices while lowering selling prices for SJC gold bullion amid ongoing supply constraints.

At Phu Quy Group, SJC gold buying prices increased by VND700,000 (US$26.6) per tael, while selling prices dropped VND300,000 compared to the previous session, quoting VND147.4 million/tael (buying) and VND148.9 million/tael (selling).

Similarly, SJC Company lifted its buying price by VND200,000 but reduced its selling price by VND300,000 quoting VND146.9 million/tael (buying) and VND148.4 million/tael (selling).

Meanwhile, the price of 9999 gold rings saw a broader decline. SJC Company reduced both buying and selling prices by VND600,000, quoting VND145.5 million/tael (buying) and VND148 million/tael (selling). Bao Tin Minh Chau also cut both prices by VND500,000 to VND150 million (buying) and VND153 million (selling).

On the global market, gold prices continued their downward trend. The closing price in New York on October 24 fell to US$4,111.2 per ounce, down $13.7 from the previous session. As of the afternoon of October 27 (Vietnam time), spot gold on Kitco traded at $4,034.2 per ounce, nearly $80 lower than last weekend’s close. When converted, this equals approximately VND128.1 million per tael, VND20.3–VND20.8 million lower than SJC bullion and VND19.9 million–VND22.9 million lower than 9999 gold rings.

The global gold decline comes ahead of the U.S. Federal Reserve (FED) policy meeting scheduled for Tuesday and Wednesday this week (local time). Despite inflation slowing more than expected, the FED is anticipated to cut interest rates, contributing to recent market adjustments. So far, international gold prices have dropped about $340 per ounce (over 7.5 percent) compared to last Tuesday’s peak of $4,380 per ounce.