|

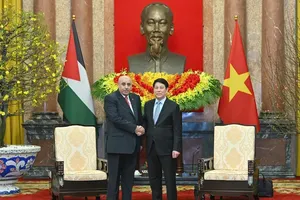

Authorised by the Prime Minister, Minister of Finance Ho Duc Phoc submits the draft resolution on the imposition of top-up corporate income tax under the GloBE rules on November 10. (Photo: VNA) |

Submitting the draft resolution on behalf of the Government, Minister of Finance Ho Duc Phoc said the global minimum tax (GMT) is not an international treaty or international commitment, and also not compulsory for countries.

However, even if Vietnam does not apply this tax, other countries that impose the GMT have the right to collect this tax from businesses in Vietnam (if the firms are subject to the tax) that pay a tax rate lower than the global minimum tax of 15 percent, especially foreign invested ones, he noted.

In that context, to ensure its rights and legitimate interests, Vietnam should apply the global minimum tax, Phoc said, citing the guidance by the Organisation for Economic Cooperation and Development (OECD) as saying that the nature of this tax is top-up corporate income tax and countries should properly include it in their legal systems.

Delivering the verification report, Chairman of the NA Committee for Financial and Budgetary Affairs Le Quang Manh said most members of the committee shared the view on the need to issue a legal document to create a legal basis for the foreign invested companies subject to the GMT to make top-up corporate income tax declarations in Vietnam, instead of letting them pay the top-ups in their parent countries.

Besides, the early issuance of the resolution will clearly reflect Vietnam’s determination to apply the global minimum tax, thus enhancing investors’ trust in the country’s legal environment, he went on.

Manh said that as the Government hasn’t moved to include regulations on this tax in the Law on Corporate Income Tax, most committee members agreed on the necessity for the NA to temporarily issue a pilot resolution on the imposition of top-up corporate income tax under the GloBE rules before amending this law in order to guarantee Vietnam’s tax collection right in accordance with the international trend and norms.

The NA Committee for Financial and Budgetary Affairs asked the Government to report its plan to revise the Law on Corporate Income Tax to ensure consistency among regulations of the law, the official continued.

He also cited experts as perceiving that the GMT application will open up opportunities for Vietnam to review and assess its current tax incentives.

Manh said that according to the Government’s impact assessment report based on the 2022 statistics, 122 foreign businesses in the country will be subject to the resolution, with the top-ups totalling VND14.6 trillion (US$600.3 million).

Meanwhile, six Vietnamese firms will be covered by the resolution, and they will have to pay about VND73 billion in top-up corporate income tax on their overseas investments if host countries do not impose the global minimum tax, the Government estimated in its report.

The GMT, agreed to by G7 countries in June 2021 as a measure to prevent tax base erosion and profit shifting by multinational corporations, will become effective on January 1, 2024 in many OECD countries. The GMT under OECD Pillar Two is a once-in-a-lifetime global tax reform that will apply to multinational companies with revenues of EUR 750 million ($800 million) or more.