Vietnam shifts from an ambiguous stance to a proactive strategy

This strategic shift is evidenced by the formation of the NDAChain blockchain infrastructure and the process of licensing digital asset exchanges. Experts note that Vietnam has rapidly integrated blockchain technology, particularly within the finance and banking sectors, where it is being applied to areas like interbank money transfers, international payments, and converting physical assets into digital assets. This platform adoption is designed to substantially reduce costs, shorten transaction times, eliminate intermediaries, and enhance overall transparency.

This technological expansion is supported by robust institutional action. Notably, the Government issued Decision No. 1236/QD-TTg on October 22, 2024, which outlines the National Strategy for Blockchain Development to 2025, with a vision to 2030. Furthermore, the Politburo's Resolution No. 57-NQ/TW in December 2024 explicitly identified blockchain as a strategic technology requiring prioritized development through 2030, underscoring the nation's commitment to innovation and digital transformation.

To concretize this vision, the Government has taken significant legislative steps, starting with the issuance of Decision No. 1131/QD-TTg on June 12, 2025, which lists strategic technologies and products, explicitly defining the priority areas for blockchain. Crucially, the National Assembly passed the Law on Digital Technology Industry on June 14, 2025. This represents a historic milestone, establishing the first clear and transparent legal corridor for the sector, particularly through the official recognition and regulation of digital assets.

Vietnam develops a self-sufficient national blockchain ecosystem

CEO Nguyen Phu Dung of PILA Technology Companny which is responsible for developing Vietnam’s national blockchain infrastructure affirmed that this technology is foundational because it inherently guarantees three core principles: authentication, integrity, and traceability.

His company has successfully built a comprehensive ecosystem to ensure the nation’s technological autonomy and expand blockchain application across key sectors. This ecosystem includes NDAChain, which functions as the official national blockchain infrastructure; NDA DID and NDA Key, which provide secure digital identity solutions for both individuals and businesses; and NDATrace, which enables product traceability through blockchain technology. These platforms are crucial for empowering Vietnam to be technologically self-sufficient and for broadening the use of blockchain into areas where transparent data is paramount, such as public administration, agriculture, commerce, and import-export.

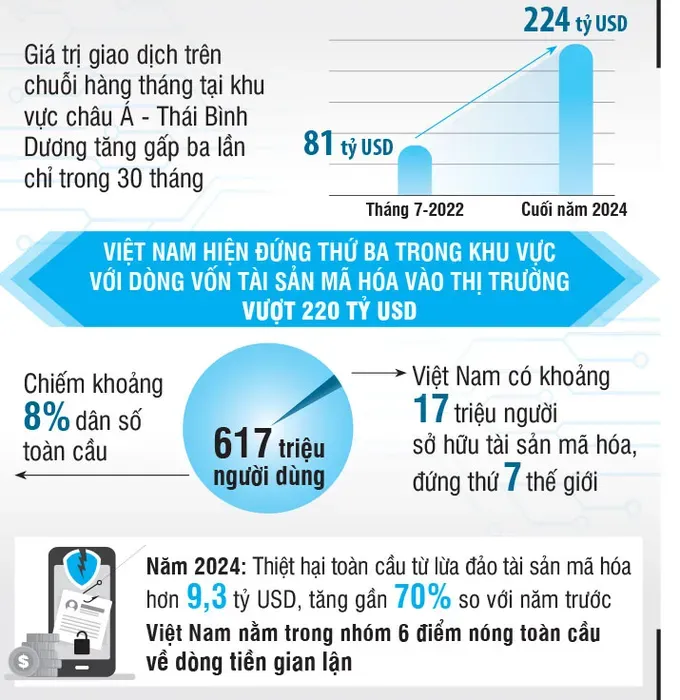

According to Deputy Director Nguyen Thi Minh Tho of the Anti-Money Laundering Department of the State Bank, the first requirement of crypto asset management is compliance with international standards on anti-money laundering, anti-terrorist financing and capital flow control. After Vietnam was put on the ‘grey list’ by the intergovernmental organization the Financial Action Task Force (FATF) in 2023, the Government committed to 17 remedial actions, including building a digital asset management mechanism. “The birth of the Digital Technology Industry Law and Resolution 05 has opened a legal corridor to recognize digital assets as legal, creating a foundation for sustainable market development,” Ms. Minh Tho emphasized.

Vietnam's regulatory approach is strict yet flexible

Deputy Director Nguyen Thi Minh Tho explained that the chosen direction is to 'manage for development,' ensuring that risk is controlled but innovation is not suppressed. Consequently, digital asset service providers must operate as financial institutions: adhering to Know-Your-Customer (KYC) protocols, reporting suspicious transactions, maintaining data records for a minimum of ten years, and continuously monitoring technology. This strict compliance framework acts as a 'shield' to guarantee market transparency and protect investors.

Deputy Head To Tran Hoa of Market Development at the State Securities Commission hailed the recently passed Resolution 05 as a historic step that aligns with the nation's goal of establishing International Financial Centers in Ho Chi Minh City and Da Nang. While the related Resolution 222/2025/QH15 focuses on specific mechanisms for these financial hubs, Resolution 05 provides a nationwide, controlled pilot framework designed to ensure security and transparency across the digital asset sector.

Being a businessman, Chairman Phan Duc Trung of the Vietnam Blockchain and Digital Asset Association affirmed that the strict regulations are necessary. He pointed out requirements—such as a minimum charter capital of VND10 trillion and a Level 4 safety system - a standard higher than that for securities companies - are intended to filter out non-serious investors and mitigate manipulation risks. However, Chairman Phan Duc Trung acknowledged that the initial pilot phase might be less dynamic, but stressed, 'that is the price to pay for forming sustainable digital trust.'