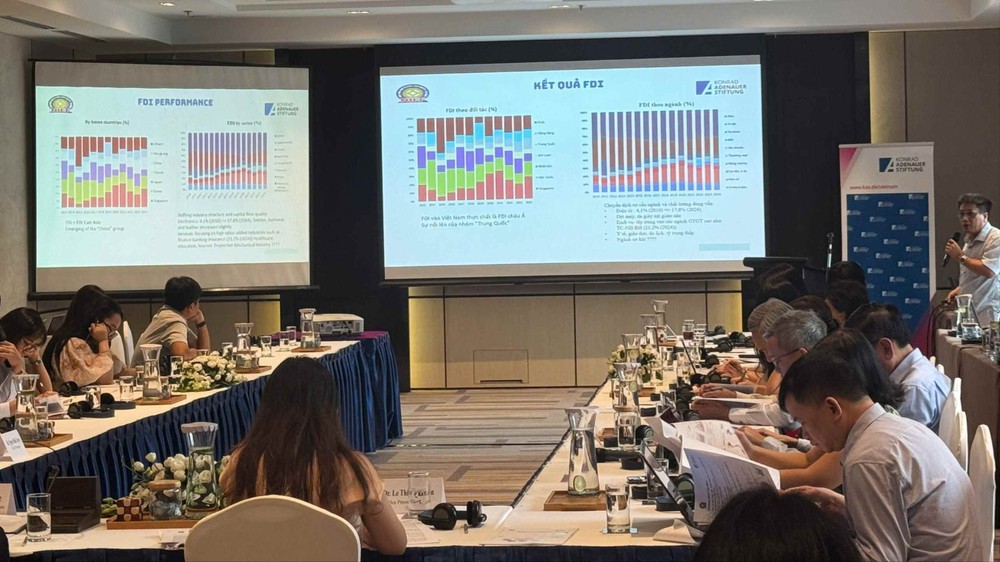

In a report presented at the event, Dr. Tran Toan Thang, Head of the Department of International and Integration Policy at the Institute for Financial Strategy and Policy under the Ministry of Finance, noted that after nearly 40 years of FDI attraction, Vietnam’s economic structure has improved significantly, with the share of industry and services in GDP rising from 73.5 percent in 2011 to 79.9 percent in 2024.

Vietnam’s Competitive Industrial Performance (CIP) has also seen notable progress, jumping from 95th place in 1990 to 31st during 2019–2022, driven largely by manufacturing and export capabilities. FDI is regarded as the backbone of Vietnam’s key industrial sectors. Although foreign-invested enterprises account for only 8 percent of all manufacturing firms, they control 56.3 percent of total investment capital, generate 61.9 percent of total revenue, and employ 59.7 percent of the sector’s workforce.

However, experts cautioned that the FDI sector’s business model remains heavily reliant on low-cost, low-skilled labor, with 72.1 percent of its workforce untrained. Labor productivity in the sector is increasing slowly and inconsistently, raising concerns about long-term sustainability.

Speaking on the sidelines of the event, Dr. Bui Quy Thuan, Head of the Research Division under the Vietnam Industrial Parks Finance Association (VIPFA), observed a positive shift in FDI structure over the past four decades. From 2010 to 2024, investment moved away from labor-intensive industries such as textiles and footwear to high-tech sectors, with electronics increasing its share from 4.1 percent to 17.8 percent.

Despite Vietnam’s growing appeal as an investment destination, labor quality and infrastructure bottlenecks are expected to adversely affect future FDI inflows. The ongoing Fourth Industrial Revolution is also seen as a double-edged sword—both an opportunity and a challenge for Vietnam in attracting high-quality FDI.

To remain competitive, Vietnam is urged to develop a new, highly selective incentive framework. Incentive levels should be directly tied to the fulfillment of key project commitments, including the share of R&D spending in Vietnam, the extent of technology transfer, the localization rate, and investment in high-quality workforce training.

Alongside incentive reform, experts called for strengthening domestic enterprises and building a genuine supporting industry, tailored support packages based on business size and sector, and enhanced policy coordination.

Notably, several participants stressed the need for a coordinated, inter-regional and cross-sectoral governance framework for FDI attraction. They also urged an end to the “race to the bottom” among localities competing on incentives, in favor of a unified, strategic, and well-planned national approach.

According to the latest data from the General Statistics Office under the Ministry of Finance, Vietnam has attracted a total of 43,346 valid FDI projects, with a combined registered capital of US$517.14 billion. Of this, approximately US$331.46 billion—or 64.6 percent—has been realized.