The VN-Index concluded the session by reversing its gains to nearly 1,210 points from its intraday peak of 1,240 points, marking a total decline of approximately 25 points.

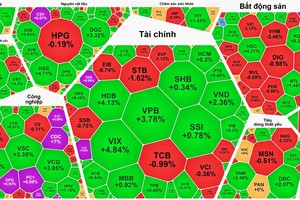

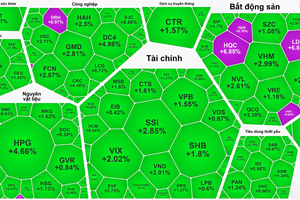

The stock market session on February 23 witnessed a tug-of-war scenario. The VN-Index sometime surged by over 10 points, driven by strong performances in the banking sector. Notably, BID stock hit a historic peak after hitting the ceiling price, contributing to pushing the VN-Index to 1,240 points.

However, when the banking stocks, which typically have a significant influence on the market, cooled down, a downward trend triggered widespread selling, causing the VN-Index to plummet uncontrollably. Following the sharp decline, a substantial inflow of capital entered the market for bottom-catching, resulting in a rapid recovery of the VN-Index to near the reference level. However, the market then experienced another downturn shortly afterward.

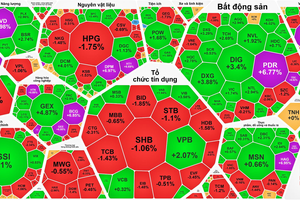

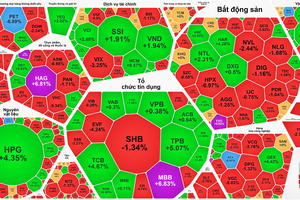

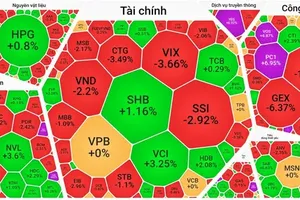

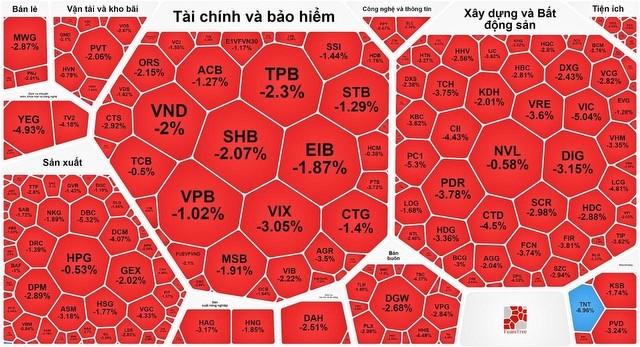

The entire market was engulfed in red. While banking stocks started the morning session on a positive note, they ended the session with only BID posting a 4.52 percent increase from its previous ceiling level. The rest of the banking sector saw declines, with STB down 1.29 percent, ACB down 1.27 percent, CTG down 1.4 percent, LPB down 3.39 percent, SHB down 2.07 percent, EIB down 1.87 percent, TPB down 2.3 percent, HDB down 1.75 percent, VIB down 2.22 percent, and OCB down 1.94 percent.

The real estate and construction sector mirrored the overall market decline, with the Vingroup trio leading the plunge. Specifically, VIC plummeted by 5.04 percent, VHM dipped by 3.35 percent, and VRE slumped by 3.6 percent. Other notable declines were observed across the board. CTD tumbled by 4.5 percent, KBC dropped by 3.62 percent, CII slid by 4.43 percent, VCG retreated by 2.82 percent, PDR fell by 3.78 percent, HDG sank by 3.36 percent, BCM declined by 2.76 percent, and SZC sagged by 2.94 percent.

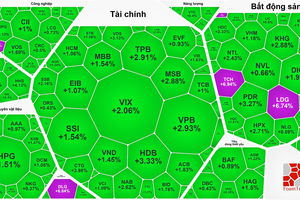

A few glimmers of green persisted in the manufacturing sector. Particularly, BMP surged by 5 percent, IDI increased by 1.28 percent, PAN rose by 1.75 percent, and VHV edged up by nearly 1 percent.

At the close of the trading session, the VN-Index plunged by 15.31 points, or 1.25 percent, to 1,212 points, with 414 stocks declining, 98 stocks advancing, and 45 stocks remaining unchanged.

On the Hanoi Stock Exchange, the HNX-Index also slumped by 2.93 points, or 1.25 percent, to settle at 231.08 points. There were 120 stocks in the green, 59 in the red, and 60 unchanged.

Market liquidity surged robustly, with total trading value on the HOSE reaching nearly VND32 trillion (US$1.3 billion), up VND14 trillion compared to the previous session.

Foreign investors continued to dump shares for the second consecutive session on the HOSE, with a net selling value totaling nearly VND768 billion.