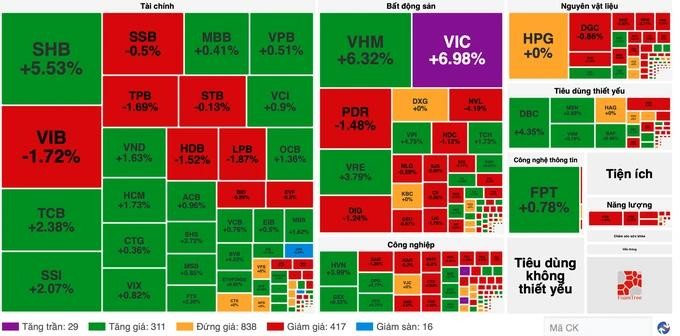

In the first trading session of the week today, the VN-Index climbed nearly 9 points. However, the market remained predominantly bearish.

A notable surge in the value of key constituent stocks significantly influenced the index's performance. Specifically, ten stocks, including VIC, VHM, VRE, TCB, SHB, HVN, SSI, ACB, VCB, and FPT, experienced substantial gains. Particularly, VIC reached its daily price ceiling, and VHM experienced a 6.32 percent increase. These ten stocks collectively contributed approximately 11 points to the VN-Index.

The stocks TPB and ORS continued their downward trend. Notably, ORS shares hit the floor price for the third consecutive session, dropping to VND10,650 per share with a closing surplus of nearly 12.3 million shares offered at the floor price with no buyers. Meanwhile, TPB shares extended their decline for a fifth consecutive session, closing 1.7 percent lower at VND14,500 per share.

The banking stock group saw a sharp increase. In addition to TCB, SHB, ACB, VCB, many other stocks also increased; for instance, BVB increased by 4.23 percent, OCB surged by 1.36 percent; MBB, VPB, CTG, EIB, MBS increased by nearly 1 percent.

The securities sector stocks demonstrated a general upward trend, with notable gains observed in HCM (1.73 percent), SHS (2.72 percent), MBS (1.62 percent), VND (1.63 percent), BSI (3.76 percent), and FTS (2.39 percent).

The real estate sector stocks exhibited a disparity in stock performance. While the Vingroup trio (VIC, VHM, VRE) experienced significant gains, the majority of remaining real estate stocks declined. Specifically, PDR, NVL, HDC, NTL, DIG, and BCM decreased by 1.48 percent, 4.19 percent, 1.12 percent, 2.12 percent, 1.24 percent, and 1.78 percent, respectively. NLG, SZC, SJS, CII, CEO, and SIP also experienced declines of nearly 1 percent.

The public investment sector stocks experienced a simultaneous decline, with VGC and PC1 decreasing by 1.55 percent and 1.29 percent, respectively, and CTD and HHV decreasing by nearly 1 percent. At market close, the VN-Index registered an increase of 8.44 points (0.64 percent), reaching 1,330.32 points, characterized by 196 advancing stocks, 249 declining stocks, and 83 unchanged stocks. The HNX-Index also recorded a marginal increase of 0.18 points (0.07 percent), closing at 246 points, with 71 advancing stocks, 91 declining stocks, and 56 unchanged stocks.

Liquidity improved but was still below VND20,000 billion, the total transaction value on the HOSE floor was nearly VND19,600 billion, an increase of VND2,600 billion compared to the previous session.

Foreign investors maintained a strong net selling trend on the HOSE exchange, with a total net selling value exceeding VND720 billion. The top three stocks experiencing the highest net selling were TPB at over VND160 billion, LPB at nearly VND68 billion, and NVL at approximately VND59 billion.