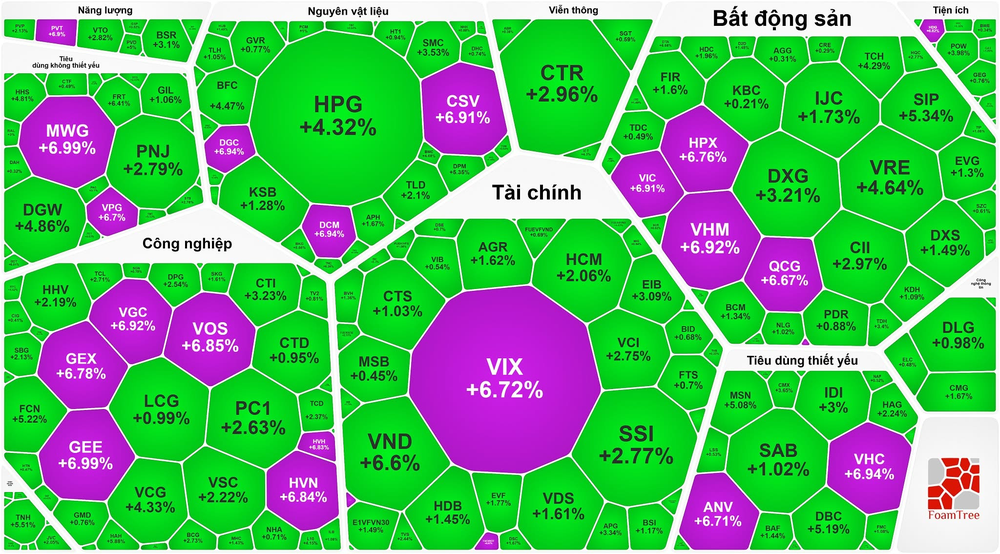

Large-cap stocks led the charge. Among the ten biggest market-cap stocks, VHM, VIC, HVN, MWG, and DGC all hit their daily upper limits. HPG rose 4.3 percent, MSN advanced 5.1 percent, GAS gained 1.9 percent, VRE climbed 4.6 percent, and BID added nearly 1 percent. Altogether, these heavyweights contributed nearly 15 of the total 19-point gain in the VN-Index.

Brokerage stocks also maintained strong momentum, with VND jumping 6.6 percent, SSI up 2.77 percent, VCI rising 2.75 percent, MBS adding 3.42 percent, SHS increasing 2.92 percent, and HCM advancing 2.06 percent.

Real estate shares rallied across the board. In addition to the Vingroup trio’s surge, DXG gained 3.21 percent, SJS rose 3.48 percent, CII added 2.97 percent, TCH climbed 4.29 percent, HDC advanced 1.96 percent, and NLG edged up 1.02 percent. Industrial real estate stocks also rebounded, with IDC rising 1.57 percent, BCM gaining 1.34 percent, and both KBC and SZC closing nearly 1 percent higher.

A wave of stocks in the industrials, consumer goods, materials, and energy sectors also hit their daily ceiling prices, including GEX, GEE, VGC, MWG, VHC, ANV, PVT, and DCM.

In contrast, bank stocks were mostly under pressure, albeit with modest declines. SSB fell 4.25 percent, LPB dipped 1.02 percent, and TPB dropped 1.14 percent. VPB, TCB, ACB, STB, and CTG each slipped by close to 1 percent.

At the close, the VN-Index advanced 18.98 points, or 1.55 percent, to 1,241.44, with 311 advancers, 179 decliners, and 48 flat. The HNX-Index also rose 1.66 points, or 0.78 percent, to 215 points, with 108 stocks gaining, 74 declining, and 42 unchanged.

Despite the market’s bullish momentum, many cash-holding investors remained hesitant to chase rising prices, leading to a dip in trading liquidity. Nonetheless, trading activity remained relatively strong, with total turnover on HOSE reaching nearly VND24.3 trillion—down VND10.5 trillion from the previous session. Combined with HNX, total market liquidity stood at over VND25.8 trillion, a decrease of VND14.7 trillion.

After finishing last week with net inflows, foreign investors returned to net selling, offloading more than VND201 billion on HOSE. The top three most net-sold stocks were VPB with VND67 billion, SHB with over VND84 billion, and VNM with VND67 billion.

SJC gold hits new record at VND107.5 million per tael despite global price dip

The price of SJC gold bars continued to surge sharply, officially reaching a new historical peak of VND107.5 million per tael for selling — the highest ever recorded, despite a slight decrease in the global gold price, on the afternoon of April 14.

Specifically, around 2 p.m., Saigon Jewelry Company (SJC), Phu Nhuan Jewelry Company (PNJ), and Bao Tin Minh Chau companies all listed the price of gold bars at VND105 million per tael for buying and VND107.5 million per tael for selling, marking an increase of VND500,000 in both directions compared to the morning session. Compared to the end of last week, the price of SJC gold has risen by VND2 million per tael in the buying rate and VND1 million per tael in the selling rate.

Phu Quy Group also raised prices by VND500,000 in both directions, with trading at VND105.3 million per tael for buying and VND107.5 million per tael for selling. Mi Hong Gold Shop in Ho Chi Minh City saw the sharpest increase, raising VND1.5 million per tael in the buying price and VND1.2 million per tael in the selling price compared to the end of last week. Their listed prices are VND105.7 million per tael for purchases and VND107.5 million per tael for sales, the highest in the market.

Thus, this afternoon, the price of SJC gold bars officially reached a new peak of VND107.5 million per tael.

The price of 9999 gold rings also saw an increase this afternoon, with Bao Tin Minh Chau lifting the buying price by VND500,000 and the selling price by VND600,000 compared to this morning. In total, the price increased by VND1 million per tael for buying and VND1.1 million per tael for selling compared to the end of last week, with trading at VND102.6 million per tael for buying and VND106.2 million per tael for selling.

PNJ bought plain gold rings at VND102 million per tael and sold them at VND105.1 million per tael, a total increase of VND800,000 per tael for buying and VND200,000 per tael for selling compared to the end of last week.

Phu Quy Group also raised their prices by VND500,000 for buying and VND300,000 for selling compared to this morning, totaling an increase of VND700,000 per tael for buying and VND500,000 per tael for selling compared to the end of last week. They quoted the price at VND102.1 million per tael for buying and VND105.4 million per tael for selling.

SJC purchased 9999 gold rings at VND102 million per tael and sold them at VND105 million per tael, up VND300,000 in the buying price and VND200,000 in the selling price compared to this morning.

In the global market, the spot gold price recorded by Kitco at 2:15 p.m. on April 14 (Vietnam time) stood at $3,229.4 an ounce, down more than $5 from the morning session. When converted to the current exchange rate, the global gold price is equivalent to VND101.2 million per tael, approximately VND6.3 million per tael lower than SJC gold bars and VND4 million per tael lower than 9999 gold rings.