Vietnam’s stock market rallied strongly during the trading session on June 3, powered by sustained inflows into rising stocks. Notably, foreign investors returned as net buyers on the HOSE after seven consecutive sessions of net selling. At one point, the VN-Index surpassed 1,350 points before easing to close at 1,347.25. Liquidity soared, with the combined trading value on the two main exchanges exceeding $1 billion.

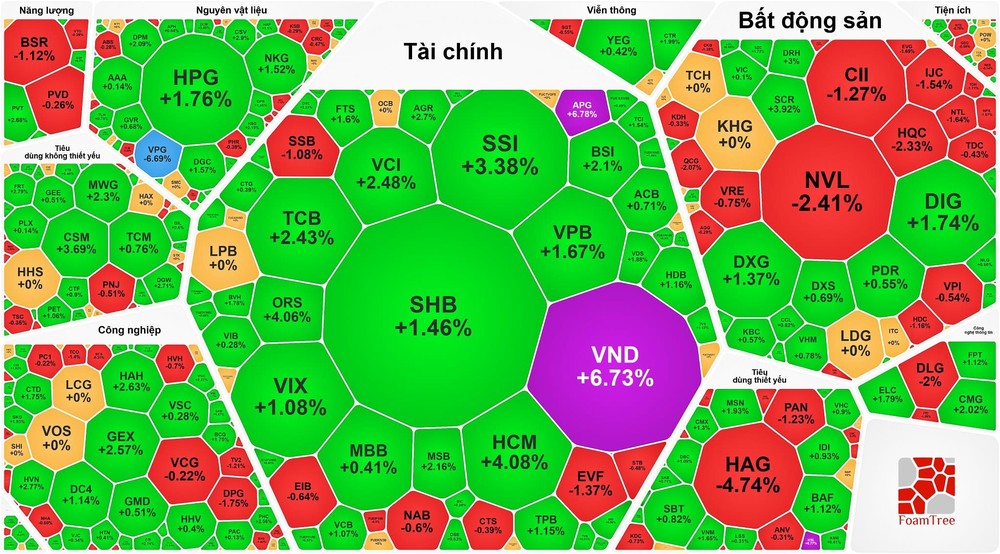

Gains were broadly seen across sectors, with market-leading brokerage stocks delivering standout performances. VND and APG hit their daily ceiling prices, while HCM surged 4.08 percent, MBS jumped 5.17 percent, SSI added 3.38 percent, SHS gained 2.99 percent, ORS advanced 4.06 percent, AGR was up 2.7 percent, VCI gained 2.48 percent, and BVS climbed 3.34 percent.

Banking stocks also posted solid gains: TCB rose 2.43 percent, SHB added 1.46 percent, VPB went up 1.67 percent, MSB gained 2.16 percent, HDB advanced 1.16 percent, TPB edged up 1.15 percent, BVB increased 2.31 percent, and VCB improved 1.07 percent.

The real estate sector saw mixed performance, though gainers outnumbered losers. CEO expanded 2.79 percent, DXG enlarged 1.37 percent, DIG built up 1.74 percent, SCR grew 3.92 percent, SZC widened 1.72 percent, and names like VHH, VIC, PDR, IDC, KBC, and NLG edged up nearly 1 percent. On the downside, NVL dropped 2.41 percent, CII fell 1.27 percent, HDC declined 1.16 percent, NTL lost 1.64 percent, HQC slipped 2.33 percent, and VRE, KDH, and VPI each shed nearly 1 percent.

Other sectors, including materials, industrials, and consumer goods, also saw robust gains. Several stocks surged more than 2 percent: DCM emerged 3.85 percent, DPM enhanced 2.09 percent, NTP added 2.43 percent, CSV escalated 2.9 percent, HSG advanced 1.19 percent, GEX hiked 2.57 percent, HVN gained 2.77 percent, HAH climbed 2.63 percent, MWG ticked up 2.3 percent, DGW added 2.71 percent, and HNG soared 4.92 percent.

At the close, the VN-Index was up 10.95 points, or 0.82 percent, to 1,347.25, with 195 stocks advancing, 119 declining, and 56 unchanged.

On the Hanoi Stock Exchange, the HNX-Index also gained 2.77 points, or 1.22 percent, to finish at 228.94, with 86 gainers, 55 losers, and 73 unchanged. Liquidity rose sharply, with the total trading value across HOSE and HNX reaching VND28.3 trillion ($1.1 billion), including VND25.8 trillion on HOSE alone—up VND4.9 trillion from the previous session.

Notably, foreign investors net bought nearly VND909 billion on HOSE, snapping a week-long streak of net selling. The top three net-bought stocks were VND (VND209 billion), SHB (VND160 billion), and NLG (VND70 billion).