Although the index failed to hold its highest level of the session, it still surpassed the previous day’s record, edging closer to the 1,370-point mark with broad-based gains across the board.

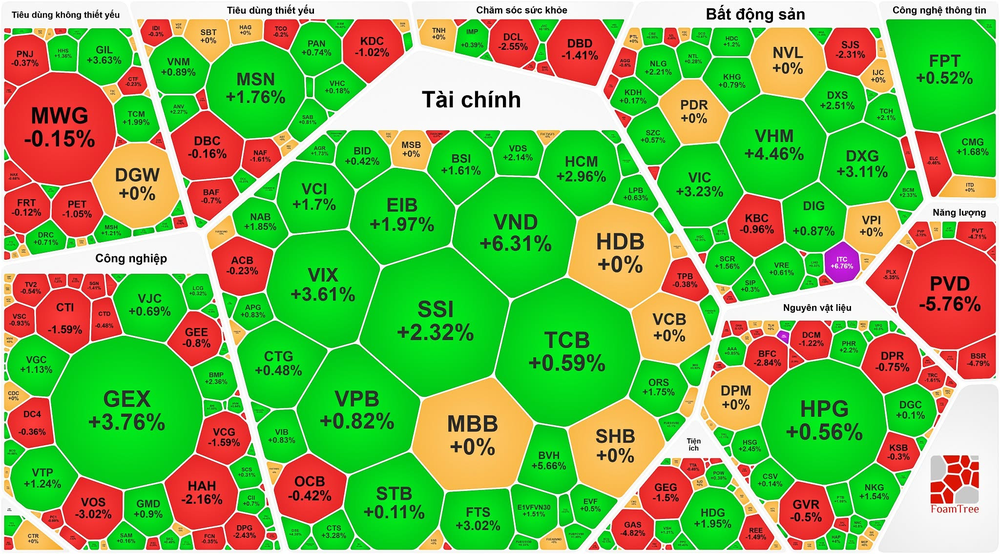

At one point during the session, the VN-Index jumped nearly 13 points to break through 1,370. However, the rally cooled by the close, with the index finishing up 8.59 points, or 0.63 percent, at 1,366.77. Notably, the market showed a healthy breadth, no longer exhibiting the narrow leadership pattern seen in recent sessions. Heavyweight stocks from the Vingroup family were among the key drivers—VHM surged 4.46 percent and VIC rose 3.23 percent—contributing nearly 6 of the 9 points gained by the benchmark.

The brokerage sector led the advance, with a series of sharp gains: VND climbed 6.31 percent, FTS gained 3.02 percent, VIX escalated 3.61 percent, SSI added up 2.32 percent, HCM advanced 2.96 percent, CTS elevated 3.28 percent, and VDS was up 2.14 percent.

Banking stocks also performed positively, with most maintaining gains or holding steady. EIB strengthened 1.97 percent, while TCB, VPB, CTG, BID, VIB, and LPB edged up nearly 1 percent each. Other key banks including HDB, MBB, SHB, VCB, MSB, and SSB closed flat.

The real estate sector showed robust momentum, with VHM and VIC leading the charge. ITC hit its upper trading limit, DXG expanded 3.11 percent, IDC enlarged 2.58 percent, NLG built up 2.21 percent, BCM grew 2.33 percent, TCH mounted 2.1 percent, and DXS increased 2.21 percent.

In contrast, oil and gas stocks faced heavy profit-taking, leading to steep losses. PVS dropped 5.98 percent, PVD fell 5.76 percent, PLX slid 5.35 percent, BSR lost 4.79 percent, and PVT declined 4.71 percent.

By the end of the trading day, the VN-Index recorded 176 advancers, 127 decliners, and 65 unchanged stocks. On the Hanoi Stock Exchange, the HNX-Index added 0.37 points, or 0.16 percent, to close at 227.79, with 95 gainers, 67 losers, and 57 unchanged stocks.

Market liquidity surged, with total trading value on the HOSE reaching over US$1 billion (VND25.6 trillion), up by VND3.8 trillion from the previous session.

Foreign investors returned as net buyers on HOSE after four consecutive sessions of net selling, posting net purchases of more than $9 million (VND230 billion). The top three net-bought stocks were DGW (nearly $8.6 million), VND (approximately $8.4 million), and SSI (around $6.1 million).