During the first 15 minutes of the ATO session, trading encountered slight disruptions due to the system transition, but soon regained stability. The morning session unfolded at a cautious pace, while the afternoon saw a clear shift in sentiment, with the market turning decisively positive. Despite a dip in overall liquidity, gains were widespread across the board.

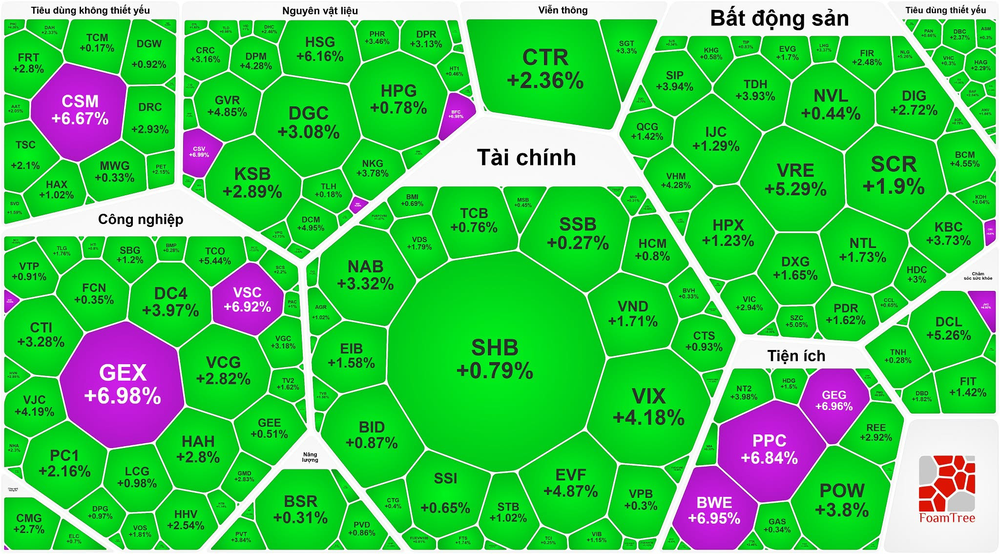

Sectors tied to public investment, utilities, and raw materials surged, with several stocks hitting their daily upper limits, including GEX, VSC, GEG, BWE, BFC, and CSV. Other standout performers included HSG, surging 6.16 percent; NKG, advancing 3.78 percent; DCM, climbing 4.95 percent; DPM, gaining 4.28 percent; and POW, rising 3.8 percent.

Financial stocks also exhibited a bullish trend, particularly in the banking and securities segments. Among banks, NAB increased by 3.32 percent, EIB added 1.58 percent, VIB edged up 1.15 percent, and BVB strengthened by 1.68 percent. In the securities group, VIX jumped 4.18 percent, FTS inched up 1.74 percent, and VND improved by 1.71 percent.

Real estate stocks showed strong momentum as well, with the Vingroup trio performing solidly — VHM rallying 4.28 percent, VRE leaping 5.29 percent, and VIC adding 2.94 percent. Other notable gainers included KBC, rising 3.74 percent; NLG, jumping 5.26 percent; DIG, adding 2.72 percent; IDC, climbing 3.59 percent; KDH, gaining 3.04 percent; and HDC, advancing 3 percent.

By the end of the trading day, the VN-Index had climbed 13.75 points, or 1.12 percent, to close at 1,240.05 points, with 233 stocks advancing, 85 declining, and 47 remaining flat. On the Hanoi Stock Exchange, the HNX-Index also edged higher, adding 0.87 points, or 0.41 percent, to settle at 212.81 points, supported by 95 advancers, 77 decliners, and 49 unchanged.

However, liquidity fell sharply. Total trading value on HOSE amounted to just over VND14.3 trillion — down approximately VND1.3 trillion from the last session before the holiday.

Foreign investors turned net buyers on HOSE, recording a net purchase of nearly VND126 billion. The most heavily sold stocks were VRE (over VND130 billion), MSN (nearly VND41 billion), and NLG (around VND40 billion).

The Ho Chi Minh Stock Exchange (HOSE) officially launched the new Information Technology system, KRX, in the Vietnamese stock market on the morning of May 5. According to Ms. Tran Anh Dao, Deputy General Director in charge of the HOSE Executive Board, the transition to the KRX system has been completed. Market participants have finished testing the system, and data reconciliation has been fully carried out, ensuring the system is stable and ready for trading.

The transition, which took place from April 29 to May 4, involved various stakeholders, including contractors, HOSE, the Hanoi Stock Exchange (HNX), the Vietnam Securities Depository and Clearing Corporation (VSDC), and over 90 market members, such as securities companies, custodian banks, and payment banks.

The data migration to KRX has been completed, and the system was successfully tested in a full-scale market trial on May 3. On May 4, the final checks were completed, including member connections, market configuration, and database monitoring. To ensure stability, over 40 technology experts from the contractor are stationed at HOSE during the initial phase.

The KRX system is designed to comprehensively manage trading and settlement activities in Vietnam's securities market. This integrated platform covers stocks, bonds, and derivatives, connecting various market participants while offering advanced monitoring features. The system merges the operations of HOSE, HNX, and VSDC, providing a unified and seamless platform.

The launch of KRX is expected to bring the Vietnamese stock market closer to its goal of being upgraded from a frontier market to an emerging market, with the potential to attract significant international capital.

On the same day, HOSE also officially launched its revamped website at www.hsx.vn.