In a session marked by lower selling pressure, investors were willing to buy at higher prices, driving the VN-Index up nearly 8 points at one point to reach 1,354 before retreating slightly to close at 1,352 points. Liquidity declined compared to the previous session.

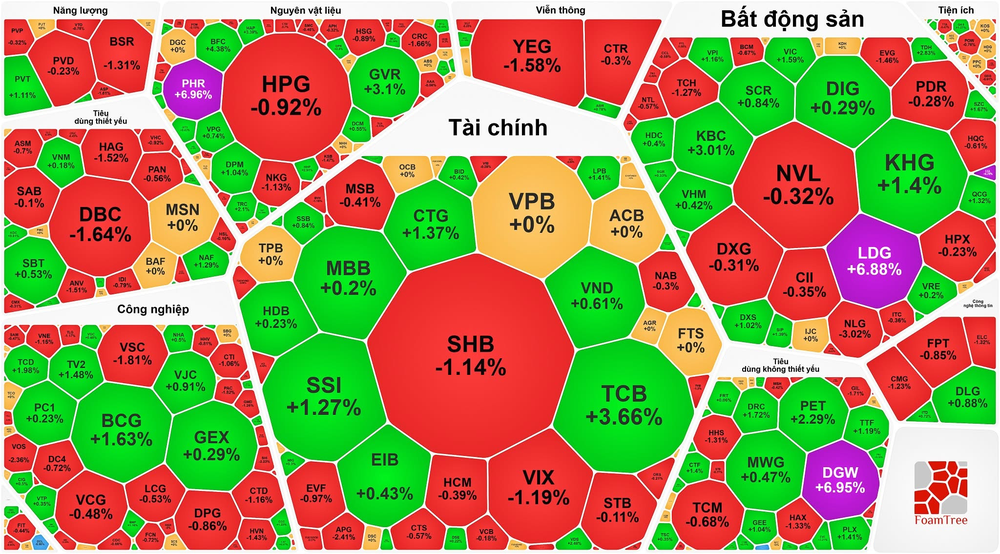

The rally was largely fueled by gains in large-cap stocks. Notably, TCB surged 3.66 percent, CTG rose 1.37 percent, VIC advanced 1.59 percent, GVR climbed 3.1 percent, and GAS added 1.27 percent.

Key sectors showed mixed performances. In the real estate group, LDG hit the ceiling price, CEO jumped 4.6 percent, KBC rose 3.01 percent, KHG gained 1.4 percent, SZC increased 1.67 percent, and VIC added 1.59 percent. Other blue chips like VHM, DIG, VRE, and HDC also edged up close to 1 percent. On the flip side, NLG dropped 3.02 percent, TCH slipped 1.27 percent, while NVL, DXG, PDR, NTL, IDC, and CII all declined by around 1 percent.

The banking sector also saw a mixed performance, though the overall tone leaned positive. Besides strong gains from TCB and CTG, several other tickers ended in the green—LPB up 1.41 percent; EIB, HDB, MBB, BID, and SSB all gained nearly 1 percent.

In contrast, the securities sector was predominantly in the red. VIX lost 1.19 percent, SHS dropped 1.54 percent, and APG tumbled 2.41 percent. Other names like VCI, HCM, MBS, ORS, CTS, and BSI shed nearly 1 percent. However, there were a few bright spots: SSI climbed 1.27 percent, VFS rallied 2.89 percent, and VND edged up nearly 1 percent.

At the close, the VN-Index advanced 5.21 points to finish at 1,352.04, with 139 gainers, 162 decliners, and 63 stocks unchanged. Conversely, the HNX-Index fell 0.64 points, or 0.28 percent, to 227.56, with 81 losers, 62 gainers, and 60 stocks unchanged.

Liquidity decreased, with total trading value on the HOSE dropping to just over VND18.7 trillion, down VND1.5 trillion from the previous session.

Foreign investors continued their net-selling streak on the HOSE for a second consecutive session, offloading nearly VND894 billion worth of shares. The top three stocks by net sell value were FPT (approximately VND389 billion), VHM (VND121 billion), and STB (VND102 billion).