The Vietnam’s stock market experienced intense volatility on June 23. During the morning session, the VN-Index dipped nearly 11 points to 1,338 before staging a sharp rebound, closing with a gain of 8.83 points, or 0.65 percent, at 1,358.18 — surpassing last week's high of 1,352.04 and setting a new historical peak.

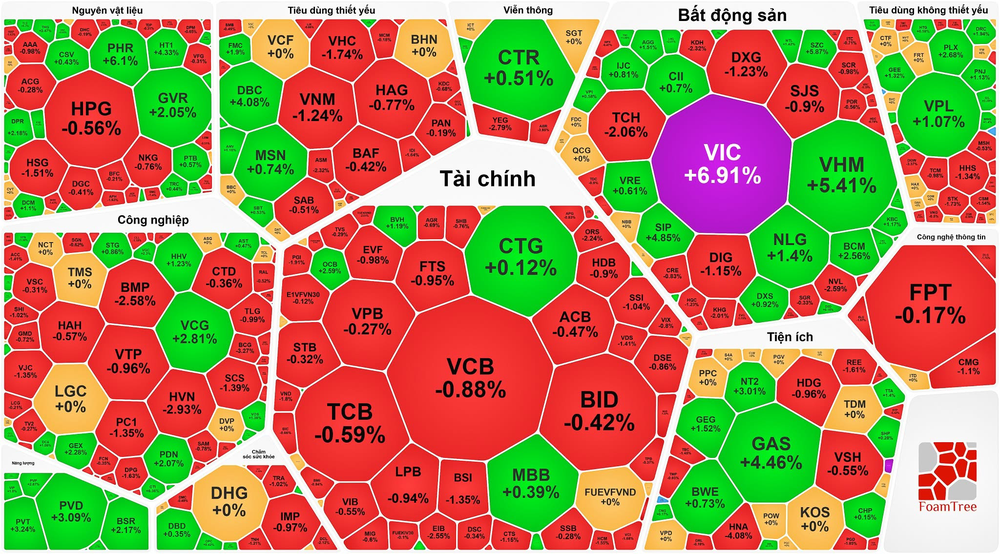

Despite the strong gain of nearly 9 points, the market reflected a classic case of narrow leadership, as decliners outpaced advancers by nearly two to one. The VN-Index's climb was largely fueled by a handful of heavyweight stocks, most notably VIC and VHM, which hit or approached their ceiling prices, and GAS, which jumped 4.5 percent. Collectively, these three stocks alone contributed close to 11 points to the index’s overall gain.

Banking and securities stocks, meanwhile, dragged on the market with broad losses. Several brokerage stocks fell more than 1 percent, including ORS (-3.34 percent), HCM (-1.55 percent), VCI (-1.68 percent), VND (-1.8 percent), SHS (-1.55 percent), BSI (-1.35 percent), and SSI (-1.04 percent).

The real estate sector continued to show significant divergence. On the upside, VIC hit its ceiling, VHM soared 5.41 percent, CEO climbed 3.35 percent, SZC skyrocketed 5.87 percent, IDC gained 2.9 percent, KBC rose 1.17 percent, and NLG added 1.4 percent. In contrast, NVL dropped 2.59 percent, KHG lost 2.01 percent, DIG fell 1.15 percent, KDH declined 2.32 percent, and DXG slipped 1.23 percent.

Oil and gas stocks continued their strong performance, with PVC hitting its ceiling price, BSR going up 2.17 percent, PVD gaining 3.09 percent, and PVS rising 1.15 percent.

By the close of trading, the VN-Index stood at 1,358.18 points with 120 advancers, 202 decliners, and 44 unchanged stocks. On the Hanoi Stock Exchange, the HNX-Index edged up 0.35 points, 0.15 percent, to 227.42 points.

Liquidity declined, with total trading value on the HOSE falling by VND500 billion compared to the previous session, reaching approximately VND21.8 trillion.

Foreign investors extended their net selling streak to a fourth session on the HOSE, though the volume of net outflows eased to nearly VND165 billion. The top three net sold stocks were VCI (nearly VND54 billion), VNM (around VND45 billion), and EIB (approximately VND45 billion).