The VN-Index plunged by nearly its full daily limit, losing 77.88 points, or 6.43 percent, to close at 1,132.79 on April 8.

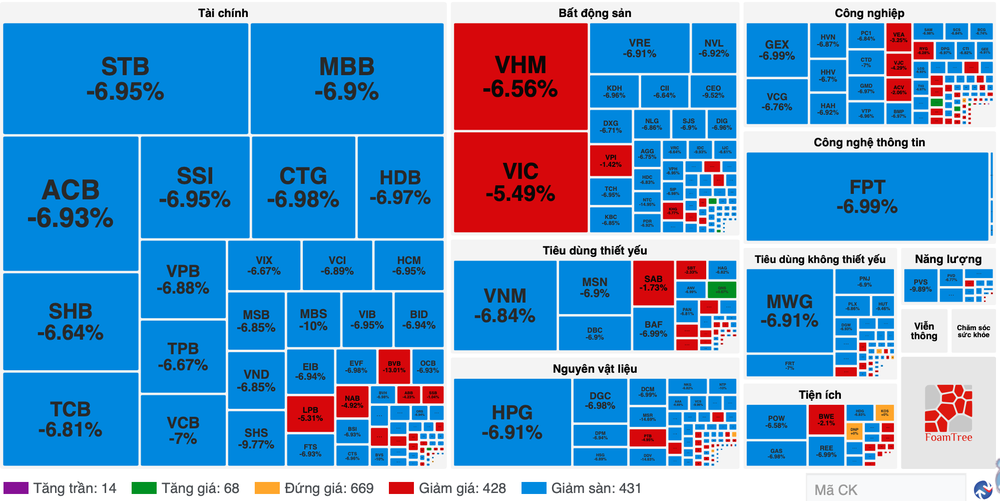

The sell-off swept across the board, with 506 stocks declining—266 of them hitting floor prices. In stark contrast, only 11 stocks gained while 14 remained unchanged. On the Hanoi Stock Exchange, the HNX-Index also posted a steep drop of 15.93 points (7.34 percent) to 201.04, with 195 decliners (102 of which fell to floor levels), 18 gainers, and 16 unchanged stocks.

Selling pressure dominated, particularly in large-cap sectors such as banking, securities, real estate, consumer goods, and materials. The top 10 heavyweight stocks—VCB, BID, CTG, TCB, VHM, VIC, FPT, HPG, GAS, and VPB—either hit or neared their lower trading limits, wiping out more than 35 points from the VN-Index alone.

Foreign investors joined the rout, ramping up net selling on the HOSE exchange with a total value exceeding VND1.08 trillion. The top three stocks facing the heaviest foreign outflows were MBB (over VND331 billion), STB (nearly VND186 billion), and VHM (more than VND173 billion).

With sell orders overwhelming weak buying demand, market liquidity dropped sharply. Total trading value on HOSE reached about VND25.3 trillion, down more than VND16.9 trillion from the previous session. Across both HOSE and HNX, combined trading value stood at approximately VND26.6 trillion—down nearly VND17.4 trillion session-over-session.