During the March 26 session, the stock market rebounded strongly from the previous session's considerable slump. Notably, foreign investors continued to dump shares for the 11th consecutive session on the HOSE, with net sales of VND stocks totaling more than VND396 billion.

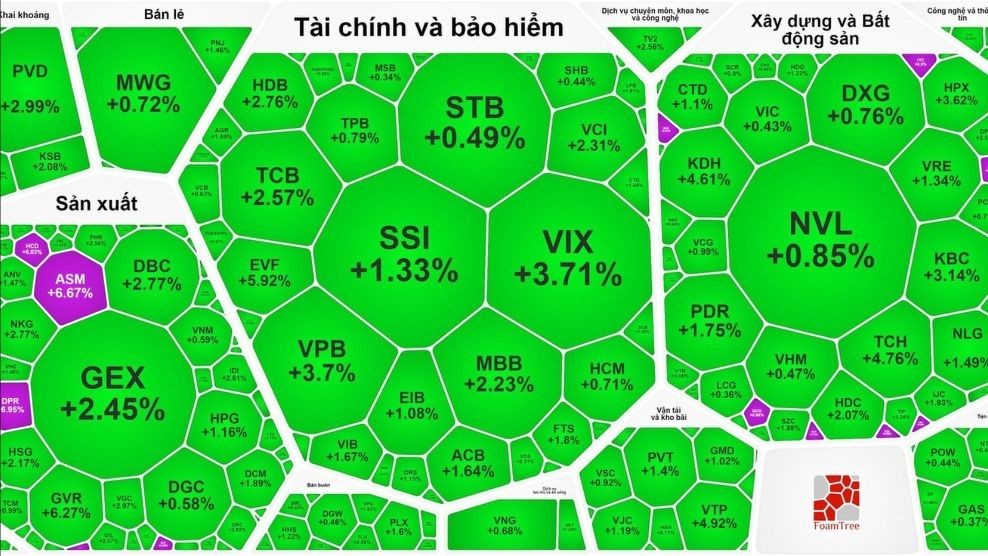

In this trading session, VNDIRECT Securities Company (VND) had yet to fully resolve the issue, and investors were still unable to log into the system to trade. However, the securities stock group showed positive signs of recovery. Apart from a 2.09 percent decrease in VND stocks, other stocks performed well. VIX increased by 2.71 percent, VCI rose by 2.31 percent, SHS surged by 1.49 percent, SSI climbed by 1.33 percent, FTS gained by 1.8 percent, and ORS advanced by 1.15 percent.

The banking stock group also contributed positively to the strong rebound of the VN-Index. VPB leaped by 3.7 percent, TCB rallied by 2.57 percent, HDB emerged by 2.76 percent, VIB grew by 1.67 percent, MBB strengthened by 2.23 percent, ACB added up by 1.64 percent, CTG heightened by 1.44 percent, and EIB mounted by 1.08 percent.

The real estate - construction stock group was also flooded in green, with significant increases. Specifically, TCH soared by 4.76 percent, KBC escalated by 3.14 percent, KDH jumped by 4.61 percent, VRE edged up by 1.34 percent, NLG enlarged by 1.49 percent, HDC expanded by 2.07 percent, and PDR widened by 1.75 percent.

The manufacturing stock group also boasted numerous purple shades, with stocks such as DPR, AMV, and ASM appearing prominently. Additionally, GVR skyrocketed by 6.27 percent, GEX hiked by 2.45 percent, NKG bounced by 2.77 percent, and HSG shot up by 2.17 percent.

At the close of the trading session, the VN-Index surged by 14.35 points, or 1.13 percent, to reach 1,282.21 points, with 342 stocks gaining, 139 losing, and 61 remaining unchanged, setting a new peak for 2024.

Meanwhile, the HNX-Index, closing at the Hanoi Stock Exchange, also saw an increase of 1.22 points, or 0.51 percent, to reach 242.03 points, with 111 winners, 55 losers, and 68 unchanged stocks.

However, liquidity experienced a significant drop, with the total trading value on the HOSE reaching roughly VND21.9 trillion, a decrease of nearly VND7 trillion compared to the previous session.

Foreign investors extended their net selling streak for the 11th consecutive session on the HOSE, with a total net selling value of nearly VND176 billion. Notably, VND stock experienced the most substantial sell-off, with a total net selling value exceeding VND396 billion.

Concerning the resolution of trading issues following a hacker attack, Mr. Nguyen Vu Long, CEO of VNDIRECT, on March 26, stated that they had received substantial support from market participants, regulatory agencies, partners, and other securities firms. Currently, VNDIRECT has nearly completed decrypting all sealed data and is initiating the system restoration process to enable reconnection and trading resumption. Although this is a common form of attack, it is relatively complex, and the company requires additional time.

Regarding the losses experienced by customers unable to access VNDIRECT's system to conduct transactions in the past two sessions and potentially extending into further sessions, Long affirmed, "After the resolution of the issue, the company will implement policies to provide additional benefits for customers, addressing the repercussions of non-trading days to ensure the protection of all customer rights."

Long also stated that all customer assets at VNDIRECT remain entirely unaffected by the incident. The company is actively re-evaluating risks associated with customer information and has not detected any thus far.