Liquidity on the HOSE alone exceeded US$1 billion.

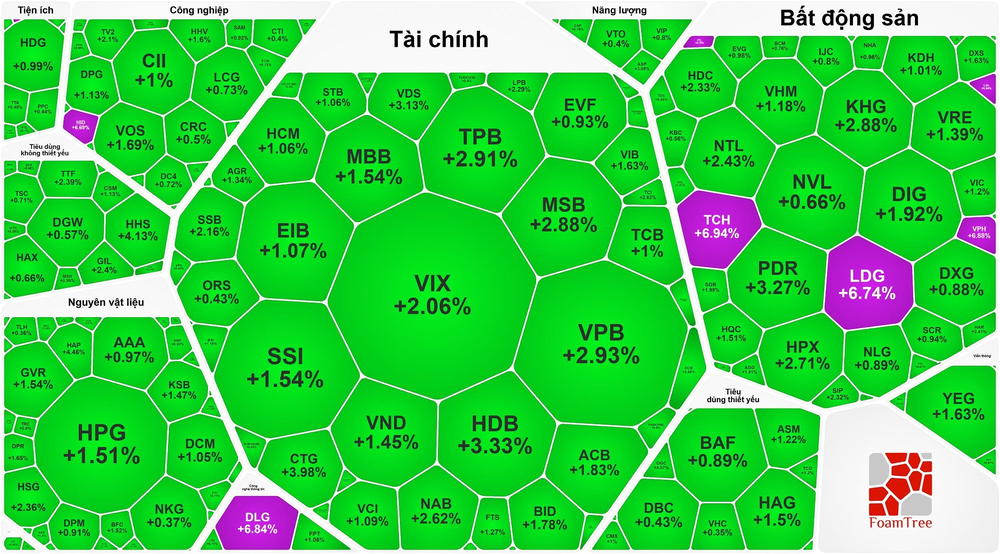

The stock market saw strong upward momentum across the board, with most sectors posting gains on July 7. Leading the rally was the banking group, which contributed significantly to the VN-Index’s rise. Among the top ten gainers by market capitalization that added nearly 10 points to the index, seven were bank stocks. SHB and NVB both hit their ceiling prices, while CTG rose 3.98 percent, BID 1.78 percent, VPB 2.93 percent, HDB 3.33 percent, MBB 1.54 percent, ACB 1.83 percent, LPB 2.29 percent, BVB 3.94 percent, ABB 2.41 percent, and TPB 2.91 percent.

Real estate stocks also staged a robust performance, with TCH and LDG hitting ceiling prices. CEO soared 5 percent, PDR jumped 3.27 percent, HDC gained 2.33 percent, while blue chips like VHM and VIC climbed 1.18 and 1.2 percent respectively. Other notable movers included VRE (+1.39 percent), NTL (+2.43 percent), KHG (+2.88 percent), and DIG (+1.92 percent).

Brokerage stocks followed suit with broad-based gains: SHS advanced 4.44 percent, VIX 2.06 percent, SSI 1.54 percent, VND 1.45 percent, FTS 1.27 percent, HCM 1.06 percent, BSI 1.18 percent, and MBS 2.19 percent.

Gains were also seen in consumer goods, steel, and IT sectors. Major names such as HPG (+1.51 percent), HSG (+2.36 percent), NKG (nearly +1 percent), HAG (+1.5 percent), as well as MSN, VNM, and DBC (each up close to 1 percent) all traded in positive territory. FPT rose 1.06 percent.

At the close, the VN-Index added 15.09 points to settle at 1,402.6 points, up 1.09 percent, with 224 stocks gaining, 87 declining, and 60 remaining unchanged. The HNX-Index also advanced, climbing 3.39 points, or 1.46 percent, to 235.9 points with 98 gainers, 70 losers, and 59 flat.

Liquidity improved markedly, with the total trading value on HOSE reaching approximately VND28.3 trillion (equivalent to $1.08 billion), up VND8.3 trillion from the previous session. Combined with HNX, total market liquidity rose to over VND30.5 trillion (nearly $1.16 billion).

Foreign investors continued their net buying spree on HOSE for the fourth consecutive session, with a net value of nearly VND1.23 trillion. The top three most heavily accumulated stocks by foreign investors were SHB with VND460 billion, FPT with VND290 billion, and SSI with VND198 billion.