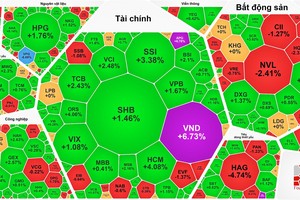

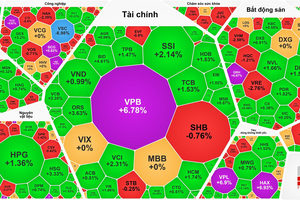

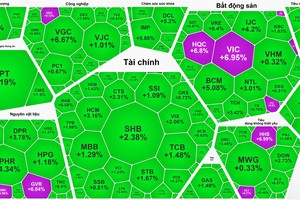

The index of 264 companies and five mutual funds listed on the Ho Chi Minh City Stock Exchange gained 0.65 percent, or 2.88 points, to finish at 445.05 points.

Trading volume dropped by 30 percent over the previous trading session as just around 28.7 million shares, worth VND690 billion changed hands.

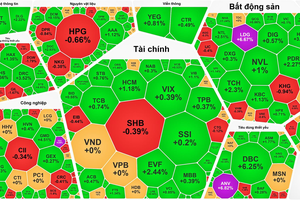

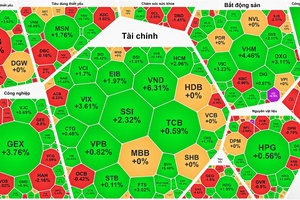

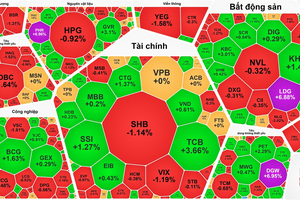

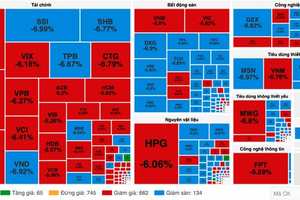

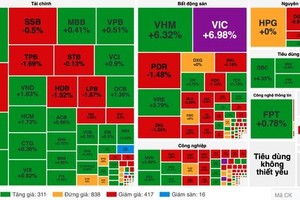

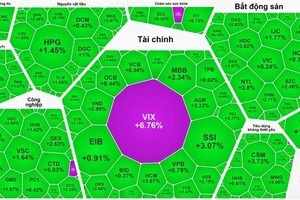

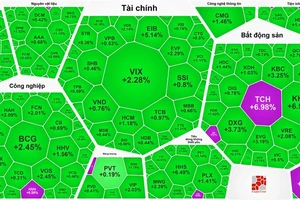

Among the index members, 97 advanced, 109 fell, and 63 remained unchanged.

Vietnam Mechanization Electrification & Construction Joint Stock Company (MCG) won the position of most active share in volume with 1.74 million shares changing hands.

It was followed by Ocean Group Joint Stock Company (OGC) with 1.47 million shares.

Saigon Thuong Tin Commercial Bank or Sacombank (STB) ranked third with 1.16 million shares.

Sacombank Securities Joint Stock Company (SBS) and Taya Vietnam Electric Wire and Cable Joint Stock Company (TYA) both soared 5 percent to VND25,200 and VND6,300 respectively.

Cuong Thuan Investment Corporation (CTI) rebounded 4.88 percent from a loss of 3.53 percent the previous day to trade at VND34,400.

Mekophar Chemical Pharmaceutical Joint Stock Company (MKP) emerged 4.82 percent to VND50,000.

Meanwhile, Ben Tre Aquaproduct Import and Export Joint Stock Company (ABT) slashed 18.89 percent to VND43,800. The company will pay dividends in cash at a ratio of 20 percent on November 11. It will also issue 2,267,927 shares to its current shareholders at a ratio of 20 percent.

An Giang Fisheries Import & Export Joint Stock Company (AGF) gave up 7.52 percent to VND24,600. The company will advance dividends in cash for the first term of this year to its current shareholders at a ratio of 10 percent on December 6.

S.P.M Corporation (SPM) lost 5 percent to VND66,500.

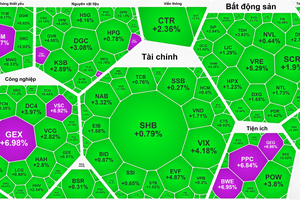

The Hanoi’s HNX-Index struggled to gain 0.24 percent, or 0.27 points, to close at 112.55 points. More than 24.8 million shares traded at VND488.8 billion, a decrease of 30 percent in volume and 26 percent in value over the previous day.

The UPCoM-Index rose 0.39 points to 42.98 points. A total of 0.23 million shares, worth more than VND3.6 billion, were changed hands.