|

Throughout the trading session, the market witnessed a tug-of-war. Eventually, the VN-Index successfully reached 1,200 points at the closing session, marking its highest level in almost a year since September 2022.

Due to investors' caution as the VN-Index approached 1,200 points, the trading session in the Vietnamese stock market on July 26 was rather lackluster. However, during the last 15 minutes of the session, the VN-Index managed to break past 1,200 points, defying the prevailing red trend on the stock board.

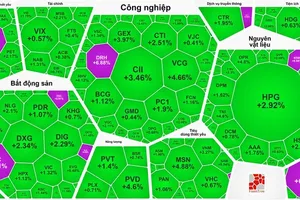

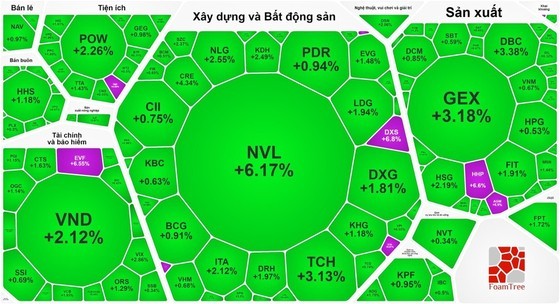

The real estate group remains at the center of the market's attention as many stocks in this sector have rebounded and surged despite facing strong profit-taking pressure. Notably, DXS and SJS reached their upper limits, while NVL rocketed by 6.17 percent, KDH advanced by 2.49 percent, NLG surged by 2.55 percent, TCH gained by 3.13 percent, ITA grew by 2.12 percent, LGC jumped by 6.57 percent, and CRE soared by 4.34 percent.

Additionally, large-cap stocks, such as POW with an increase of 2.26 percent, PNJ with an increase of 1.61 percent, FPT with an increase of 1.72 percent, SAB with an increase of 2.28 percent, and MSN with an increase of 1.44 percent, played a significant role in driving the VN-Index up for the fourth consecutive session, successfully conquering the 1,200-point mark again after nearly a year.

Other sectors, such as finance, banking, retail, and energy, continued showing varying performances. Specifically, in the banking sector, VCB increased by 1.85 percent, BID inched up by 0.42 percent, and SSB edged up by 0.34 percent, while several stocks like CTG, MBB, HDB, VIB, TCB, STB, and SHB experienced slight declines of less than 1 percent.

In the securities group, VIX rose by 2.86 percent, CTS strengthened by 1.63 percent, ORS climbed by 1.29 percent, SSI added up nearly 1 percent, and VND enhanced by 2.12 percent. However, other stocks like HCM, FTS, BVS, and TVS saw a decline.

By the end of the trading session, the VN-Index had risen by 4.94 points, or 0.41 percent, to close at 1,200.84 points, with 213 advancing stocks, 246 declining stocks, and 85 unchanged stocks.

Meanwhile, the Hanoi Stock Exchange saw a slight decline of 0.73 points, or 0.31 percent, in the HNX-Index, settling at 236.2 points.

The market experienced a significant decrease in liquidity, with the total trading value across the entire market amounting to nearly VND19.9 trillion, down by over VND2 trillion compared to the previous trading session. Despite this, foreign investors maintained their net buying trend, making a net purchase of nearly VND402 billion on the HOSE.