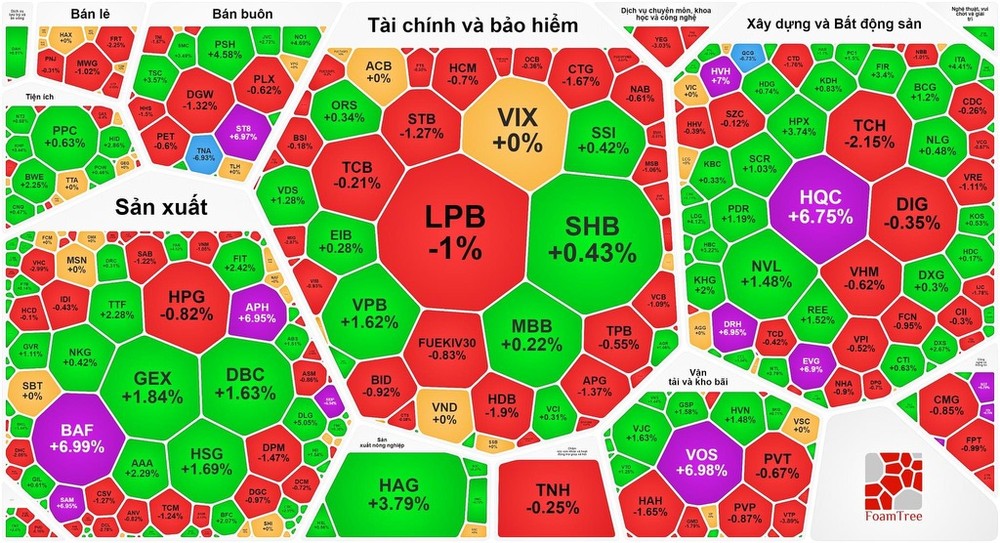

Trading on May 13 was characterized by relatively low liquidity as investors held back from bottom-fishing. Banking stocks predominantly trended downwards, putting strong negative pressure on the benchmark. Specifically, STB fell by 1.27 percent, CTG declined by 1.67 percent, VCB dropped by 1.09 percent, HDB decreased by 1.9 percent, MSB slipped by 1.06 percent, and LPB slid by 1 percent; TCB, VIB, TPB, and BID also recorded declines of nearly 1 percent.

The securities sector showed some differentiation but remained within a narrow range. VDS rose by 1.28 percent, AGR increased by 1.06 percent, while VCI and SSI saw gains of nearly 1 percent. Conversely, ORS, SSI, and BVS retreated by 2.5 percent; FTS, CTS, and BSI sank by almost 1 percent.

Similarly, there was divergence in the real estate and construction sector. HQC hit the ceiling, TCH slumped by 2.15 percent, VRE reduced by 1.11 percent, CTD collapsed by 1.76 percent, and BCM crumbled by 1.4 percent; VHM, DIG, DPG, SZC, HHV, VCG, and CII saw declines of nearly 1 percent. Conversely, NVL rose by 1.48 percent, PDR increased by 1.19 percent, NTL surged by 2.79 percent, BCG emerged by 1.2 percent, and HUT climbed by 1.16 percent; KBC, CEO, NLG, DHG, and HDC shrank by nearly 1 percent.

The manufacturing sector traded positively, with APH, BAF, and SAM hitting the ceiling, DBC escalating by 1.63 percent, GEX gaining by 1.84 percent, GVR strengthening by 1.11 percent, and PAN surging by 4.02 percent. Similarly, the transportation and seaport sector witnessed significant gains. Specifically, VOS hit the ceiling, HVN elevated by 1.48 percent, and VJC soared by 1.63 percent.

Meanwhile, the retail sector was flooded in the red, with FRT plunging by 2.25 percent, MWG sinking by 1.02 percent, DGW weakening by 1.32 percent, and PET losing by nearly 1 percent.

The VN-Index went down by 4.52 points, or 0.36 percent, to close at 1,240.18 points, with 233 stocks declining, 203 advancing, and 72 remaining unchanged. Conversely, the HNX-Index of the Hanoi Stock Exchange rose by 0.68 points, or 0.29 percent, to finish at 236.36 points, with 105 stocks advancing, 69 declining, and 65 remaining unchanged.

Trading volume remained low, with the total trading value on the HOSE reaching roughly VND17.3 trillion.

Foreign investors continued their selling trend, net selling for the fourth consecutive session on the HOSE, with a total net selling value of nearly VND853 billion.