After briefly touching an intraday high of 1,524 points, Vietnam's VN-Index saw significant profit-taking from investors, causing it to close the session lower at 1,512.31 points. Despite this retraction, market liquidity soared, reaching VND41,200 billion, equivalent to approximately US$1.57 billion.

The stock market experienced significant volatility during the July 23 session. In the morning, the VN-Index continued to rise nearly 14 points, later narrowing the gain to just under 3 points by the session's close. Despite this, the VN-Index still managed to set a new record high.

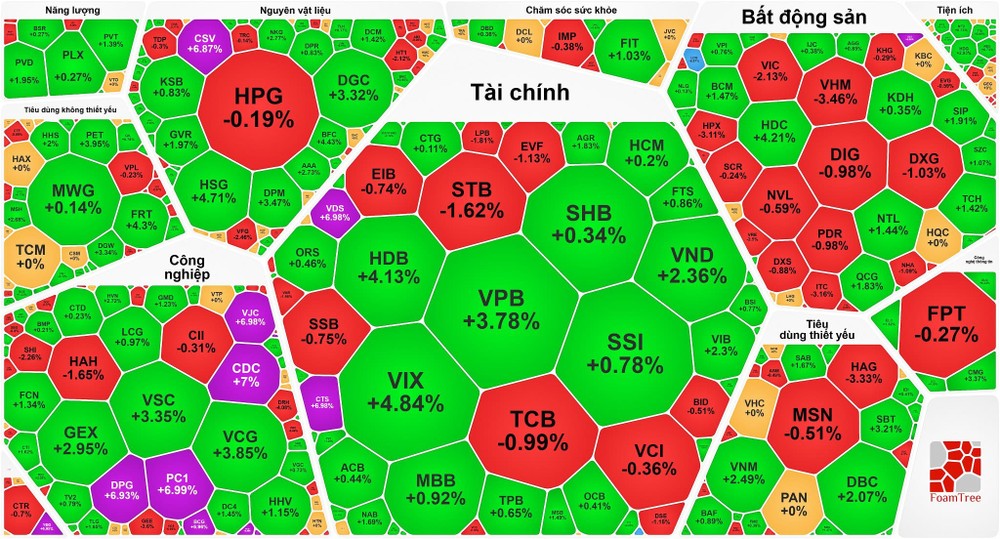

The securities stock group maintained its upward momentum; for instance, CTS and VDS reached their maximum prices, VIX increased by 4.84 percent, VND appreciated by 2.36 percent, SHS grew by 2.3 percent, AGR rose by 1.83 percent, BVS advanced by 1.36 percent; SSI, HCM, and BSI saw an increase of nearly 1 percent.

The banking group was mixed. VPB rose 3.78 percent, HDB increased 4.13 percent, VIB gained 2.3 percent, BVB rose 3.6 percent, MSB increased 3.6 percent; TPB, CTG, ACB, and MBB were up nearly 1 percent. On the contrary, STB dropped 1.62 percent, LPB fell 1.81 percent; TCB, EIB, SSB, VCB, and BID were down nearly 1 percent.

The real estate sector was also mixed. CEO dropped 1.79 percent, DXG fell 1.02 percent, VIC declined 2.13 percent, VHM decreased 3.46 percent, VRE lost 2.5 percent; NVL, PDR, and SCR dropped nearly 1 percent. On the other hand, HDC rose 4.21 percent, TCH increased 1.42 percent, IDC rose 1.32 percent, NTL climbed 1.44 percent, SZC gained 1.07 percent, SIP rose 1.31 percent; NLG and KDH were up nearly 1 percent.

Industrial stocks experienced a significant surge. DPG, VJC, CDC, and PC1 reached their maximum price limits while VSC rose by 3.35 percent, GEX increased by 2.95 percent and VCG advanced by 3.85 percent.

At market close, the VN-Index rose 2.77 points (0.18 percent) to 1,512.31 points with 203 stocks gaining, 120 declining, and 56 unchanged. On the Hanoi Stock Exchange, the HNX-Index also rose 1.48 points (0.6 percent) to 249.33 points with 90 gainers, 74 decliners, and 69 flat.

Liquidity rose sharply, with total trading value on HOSE reaching nearly VND38,200 billion (about $1.45 billion), up VND5,600 billion from the previous session. Including the HNX, liquidity reached VND41,200 billion (nearly $1.57 billion).

Foreign investors returned to net buying, with nearly VND249 billion on the HOSE. The top three most purchased stocks were VPB (with nearly VND219 billion), HDB (with about VND112.37 billion) and SSI (with around VND104 billion).