On January 31, the stock market witnessed a substantial downturn, primarily driven by a slump in the banking stock group, which had an adverse effect on the entire market.

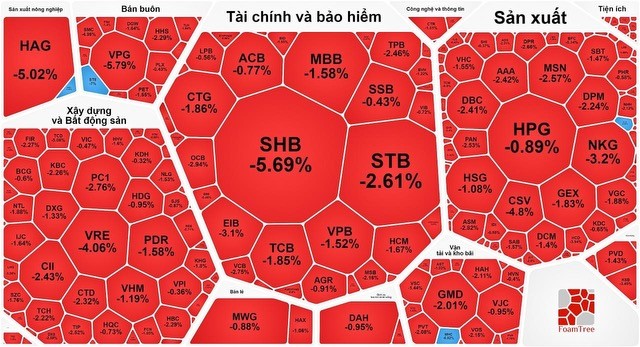

Specifically, the substantial downturn in numerous banking shares exerted significant pressure on the indices. SHB witnessed a 5.69 percent decrease, EIB experienced a 3.1 percent dip, VCB saw a 2.75 percent drop, STB declined by 2.61 percent, CTG decreased by 1.86 percent, BID had a 1.55 percent fall, MBB recorded a 1.58 percent decrease, TCB fell by 1.85 percent, VPB registered a 1.52 percent decline, MSB observed a 2.16 percent drop, TPB went down by 2.46 percent, and OCB faced a 2.94 percent decline.

The securities stock group exhibited strong performance throughout most of the session; however, towards the end, it faced selling pressure in line with the overall market, resulting in a downturn for some stocks. HCM declined by 1.67 percent, and OGC decreased by 1.07 percent. SHS, VND, and ARG each experienced a nearly 1 percent drop. Despite this, many stocks retained positive momentum. Specifically, FTS surged by 5.62 percent, VCI increased by 2.02 percent, CTS went up by 1.54 percent, SSI, VIX, and VDS gained by nearly 1 percent.

The real estate and construction sector showed some divergence but tilted towards negative performance. Of which, the Vingroup trio dropped steeply, with VRE plunging by 4.06 percent, VHM falling by 1.19 percent, and VIC weakening by nearly 1 percent. Additionally, DXG reduced by 1.33 percent, CTD shrank by 2.32 percent, NLG diminished by 1.53 percent, PDR lowered by 1.58 percent, HUT contracted by 2.54 percent, CII cut by 2.43 percent, SZC minimized by 1.76 percent, HHV lessened by 1.6 percent, and TCH trimmed by 2.22 percent. Only a few stocks managed to sustain positive momentum, with NVL rising by 1.52 percent and DPG, LCG, DIG, and ITA edging up by nearly 1 percent.

The manufacturing stock group saw sharp decreases. NKG declined by 3.2 percent, MSN retreated by 2.57 percent, DBC slashed by 2.41 percent, HSG slid by 1.08 percent, DCM dumped 1.4 percent, and GVR lost by 2.4 percent.

Closing the trading session, the VN-Index collapsed 15.34 points, or 1.3 percent, to close at 1,164.31 points. The market featured 393 declining stocks, 101 advancing stocks, and 62 unchanged stocks.

At the Hanoi Stock Exchange (HNX), the HNX-Index also experienced a dip of 1.48 points, or 0.64 percent, to finish at 229.18 points, with 94 losers, 64 winners, and 74 unchanged stocks.

Robust selling pressure contributed to a significant surge in market liquidity, with the total trading value on the HOSE reaching nearly VND23.3 trillion—an increase of almost VND10 trillion compared to the previous session. Considering the overall market, the total trading value surged to nearly VND26.9 trillion.

As local investors dumped shares heavily, foreign counterparts maintained their net buying activity with an accumulated net purchase of nearly VND122 billion on the HOSE.