|

On August 1, the Vietnamese stock market corrected after a notable surge in the VN-Index during July 2023. In that period, the VN-Index had risen by more than 100 points, approximately 9 percent. During the trading session, investors observed a strong "wave-like" movement in the market.

During the trading session, the VN-Index saw an initial increase of nearly 12 points. However, as the session neared its end, selling pressure throughout the entire market intensified. As a result, the VN-Index reversed its course and suffered a sharp decline from its peak level of 1,234.56 points to 1,217.56 points, representing a drop of approximately 17 points.

Investors' attention is centered on the industrial zone real estate and public investment stocks. Notably, stocks like VCG and CC1 hit the ceiling after being part of the winning consortium for the Long Thanh Airport project, valued at over VND35 trillion.

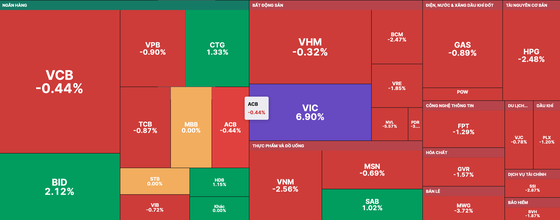

Moreover, several other stocks in the same sector also registered notable gains, with IDC rising by 5.75 percent and VGC increasing by 2.5 percent. On the contrary, CTD fell to the floor. Furthermore, VIC stock continued to reach the daily trading limit for the second consecutive session, playing a significant role in cushioning the sharp decline of the VN-Index.

The other sectors, including securities, real estate, and banking, saw a significant decline in the majority of their stocks. Except for VIC, only a few large-cap stocks like CTG, BID, HDB, and SAB managed to stay in positive territory, while the rest experienced losses.

At the end of the trading session, the VN-Index dropped by 5.34 points, or 0.44 percent, to close at 1,217.56 points. Of the index, there were 310 losers, 156 winners, and 79 stocks remained unchanged.

Meanwhile, the HNX-Index closed at 239.35 points, down by 0.21 points, or 0.09 percent, on the Hanoi Stock Exchange, with 125 stocks retreating, 72 advancing, and 135 standing still.

Market liquidity improved significantly as the total trading value across the entire market reached nearly VND30.1 trillion. Specifically, on the HOSE exchange, the trading volume surpassed 1.28 billion shares, amounting to a total value of over VND26.4 trillion.