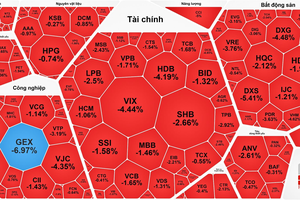

While foreign investors continued their persistent selling spree, the early-week trading session unexpectedly encountered strong selling pressure from domestic investors, causing the market to lose crucial support and sending the VN-Index plummeting to near the 1,250-point mark.

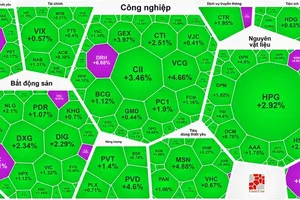

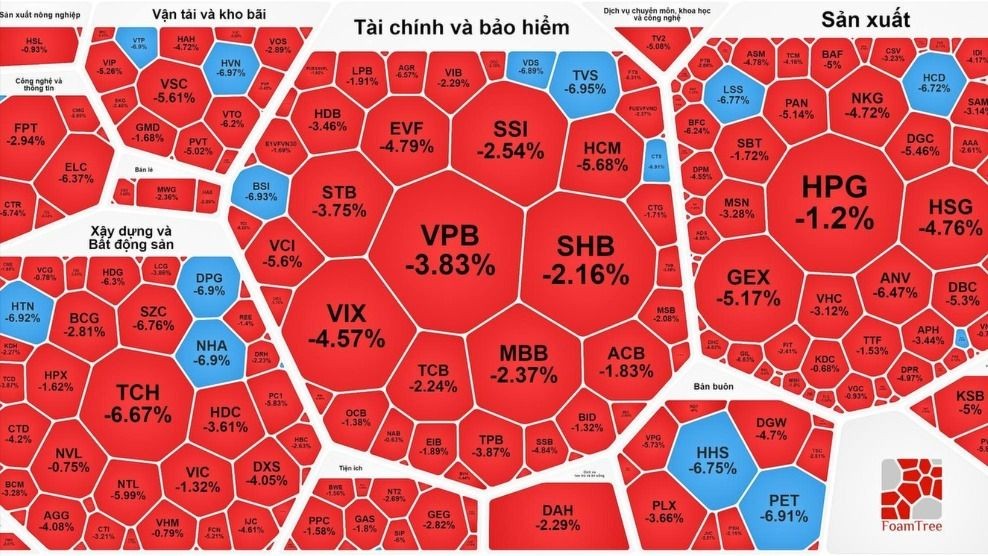

The stock market in the trading session on June 24 was dominated by red. Large-cap stocks experienced heavy selling, sparking widespread declines across the board. The only exception was the utility stock POW, which defied the market trend with a 2 percent increase.

In various sectors, the securities group suffered sharp losses, with many stocks hitting their limit-down or near-limit levels. Specifically, CTS, TVS, BSI, and VDS hit the floor; FTS plunged by 6.12 percent, VCI slumped by 5.6 percent, HCM nosedived by 5.68 percent, AGR plummeted by 6.57 percent, and VIX collapsed by 4.57 percent.

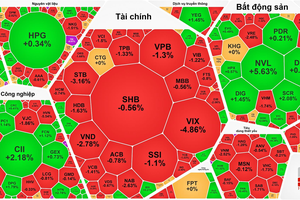

The banking sector also experienced notable declines, with several stocks falling by over 2 percent. Particularly, SSB lost by 4.84 percent, HDB sank by 3.46 percent, VPB fell by 3.83 percent, TPB declined by 3.87 percent, STB retreated by 3.75 percent, SHB weakened by 2.16 percent, VIB diminished by 2.29 percent, MSB went down by 2.08 percent, and TCB lessened by 2.24 percent.

The real estate and construction stocks performed strongly at the beginning of the session, but by the end, only a few stocks remained in positive territory. DIG rose by 1.53 percent, KBC climbed by 1.36 percent, and DXG, PDR, and KOS edged up by nearly 1 percent. Others saw significant declines, with DPG and NHA hitting the floor, TCH diving by 6.67 percent, HDG dropping by 6.3 percent, CTS waning by 4.2 percent, HDC lowered by 3.61 percent, NTL cut by 5.99 percent, and SZC slashed by 6.76 percent.

Stocks in the manufacturing, transportation, warehousing, and oil sectors also faced heavy selling pressure. In transportation, VTP and HVN reached the lower limit. Many manufacturing stocks dropped by over 4 percent. Specifically, DBC fell by 5.3 percent, GEX curtailed by 5.17 percent, DGC subsided by 5.46 percent, HSG minimized by 4.76 percent, NKG contracted by 4.72 percent, DPM ebbed by 4.55 percent, and DCM narrowed by 4.03 percent.

At the end of the trading session, the VN-Index declined by 27.9 points, or 2.18 percent, to 1,254.12 points, as 378 stocks declined, only 74 advanced, and 50 remained unchanged. Meanwhile, on the Hanoi Stock Exchange, the HNX-Index also decreased by 4.62 points, or 1.89 percent, to 239.74 points, with 139 stocks declining, 65 advancing, and 38 standing still. Market liquidity significantly increased, with trading value on HOSE surpassing VND31.8 trillion.

Foreign investors remained net sellers on HOSE, with total net sales amounting to nearly VND926 billion.