The Vietnam stock market witnessed another distribution session with a sharper decrease in the trading session on December 6 after a long winning streak nearly three weeks ago. Nearly 150 stocks across the market hit the floor, including many large-cap stocks dropping drastically, pulling the VN-Index down by nearly 45 points.

The positive information on the expansion of credit room from the SBV seems to have been absorbed into the stock price, so in this trading session, domestic investors have massively sold stocks, causing several real estate, securities, banking, and steel stocks to fall to the floor.

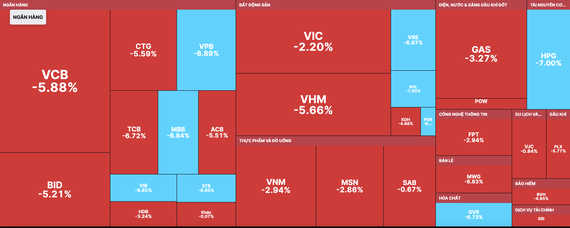

The selling pressure mainly came from domestic investors because foreign investors continued to buy nearly VND785 billion on the HoSE. A series of blue-chip stocks were sold, causing many stocks to plunge deeply. All 30 largest-cap stocks on the HoSE plummeted. Of these, VPB, VRE, HPG, PDR, GVR, MBB, STV, and VIB fell to the floor, putting great pressure on the index.

Many other stocks, such as BID, ACB, ABB, CTG, EIB, and TCB, declined by over 5 percent.

Securities stocks are also very sensitive to market fluctuations, so they reacted quickly when HCM, VCI, MBS, SBS, SHS, VDS, and VIX registered a maximum daily loss of 7 percent.

Real estate stocks also made a downturn, with CEO, DXG, DXS, HDC, HQC, IDJ, LDG, LGL, NBB, NVL, PDR, SCR, and QCG hitting the floor.

The sharp decrease in stock prices was triggered by a recent long winning streak. Many banking, real estate, and securities stocks have recovered by 30-50 percent from the bottom in a short time. This market correction is considered normal amid the selling pressure due to the profit-taking of investors who successfully caught the bottom.

Meanwhile, on the market, there were still stocks that went upstream and hit the ceiling price, such as VHC, IDI, HAG, HNG, and ANV.

At the end of the session, the VN-Index sank 44.98 points, or 4.11 percent, to close at 1,048.69 points, with 391 losers, 87 winners, and 31 unchanged stocks.

Closing the session on the HNX, the HNX-Index also slumped 7.16 points, or 3.26 percent, to 212.8 points, with 132 stocks falling, 52 increasing, and 48 standing still. Market liquidity improved significantly, with the total trading value of the whole market at nearly VND27 trillion, of which the HoSE accounted for more than VND23.53 trillion.

The positive information on the expansion of credit room from the SBV seems to have been absorbed into the stock price, so in this trading session, domestic investors have massively sold stocks, causing several real estate, securities, banking, and steel stocks to fall to the floor.

The selling pressure mainly came from domestic investors because foreign investors continued to buy nearly VND785 billion on the HoSE. A series of blue-chip stocks were sold, causing many stocks to plunge deeply. All 30 largest-cap stocks on the HoSE plummeted. Of these, VPB, VRE, HPG, PDR, GVR, MBB, STV, and VIB fell to the floor, putting great pressure on the index.

Many other stocks, such as BID, ACB, ABB, CTG, EIB, and TCB, declined by over 5 percent.

Securities stocks are also very sensitive to market fluctuations, so they reacted quickly when HCM, VCI, MBS, SBS, SHS, VDS, and VIX registered a maximum daily loss of 7 percent.

Real estate stocks also made a downturn, with CEO, DXG, DXS, HDC, HQC, IDJ, LDG, LGL, NBB, NVL, PDR, SCR, and QCG hitting the floor.

The sharp decrease in stock prices was triggered by a recent long winning streak. Many banking, real estate, and securities stocks have recovered by 30-50 percent from the bottom in a short time. This market correction is considered normal amid the selling pressure due to the profit-taking of investors who successfully caught the bottom.

Meanwhile, on the market, there were still stocks that went upstream and hit the ceiling price, such as VHC, IDI, HAG, HNG, and ANV.

At the end of the session, the VN-Index sank 44.98 points, or 4.11 percent, to close at 1,048.69 points, with 391 losers, 87 winners, and 31 unchanged stocks.

Closing the session on the HNX, the HNX-Index also slumped 7.16 points, or 3.26 percent, to 212.8 points, with 132 stocks falling, 52 increasing, and 48 standing still. Market liquidity improved significantly, with the total trading value of the whole market at nearly VND27 trillion, of which the HoSE accounted for more than VND23.53 trillion.