The cash flow continued to pour heavily into the market, with trading volume exceeding US$1.5 billion.

In the trading session on March 22, the stock market concluded with its 7th consecutive winning session and a notable surge in liquidity. However, there was neither a hint of purple nor the dominance of winning stocks like in the previous session. Instead, the number of advancing and declining stocks was balanced.

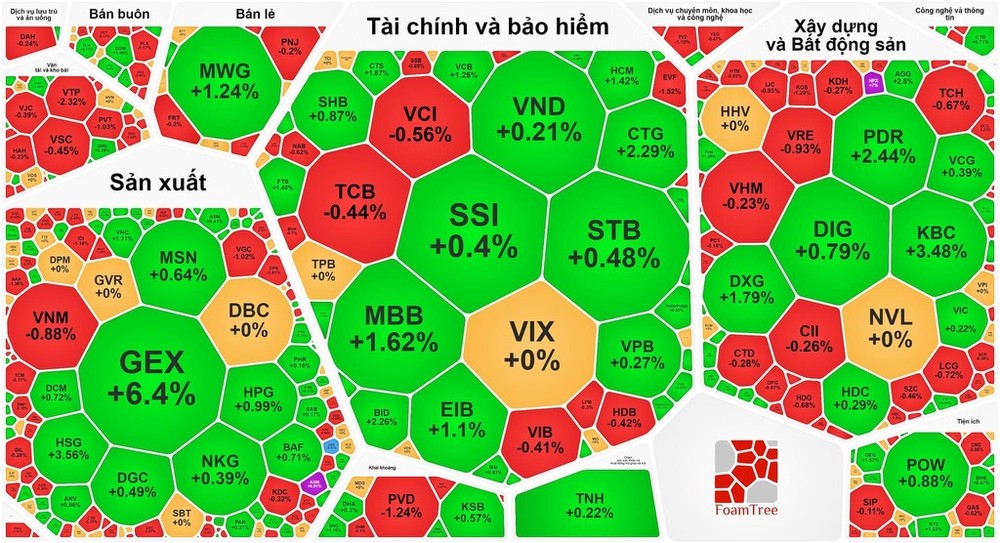

The banking stock sector continued to attract the cash flow, resulting in more gains than losses. Specifically, BID advanced by 2.26 percent, MBB rose by 1.62 percent, CTG surged by 2.29 percent, EIB rallied by 1.1 percent, VCB climbed by 1.26 percent, and MSB saw a rise of 1.01 percent; STB, VPB, and SHB registered gains of nearly 1 percent. Conversely, TCB, VIB, LPB, HDB, and NAB experienced declines of nearly 1 percent.

Most of the securities stocks also saw upward movement. BSI soared by 5.93 percent, FTS enhanced by 1.48 percent, MBS added up by 1.02 percent, CTS mounted by 1.87 percent, AGR inflated by 1.44 percent, and HCM strengthened by 1.42 percent, SHS, VND, and SSI grew by nearly 1 percent.

The construction and real estate sector saw some divergence, with the declining stocks showing modest decreases. HUT fell by 1.03 percent, and BCG dropped by 1.23 percent. Meanwhile CII, VRE, VHM, CTD, TCH, SZC, LCG, KDH, HDG, and NTL slid by nearly 1 percent. On the contrary, the rising stocks in this sector recorded larger gains, with KBC soaring by 3.48 percent, DXG winning by 1.79 percent, PDR elevating by 2.44 percent, FCN enlarging by 1.25 percent, DIG, CEO, VIC, VCG, and NLG building up by nearly 1 percent.

At the close of the trading session, the VN-Index gained 5.38 points, or 0.42 percent, reaching 1,281.8 points, with 248 stocks advancing, 231 declining, and 77 remaining unchanged.

Similarly, on the Hanoi Stock Exchange (HNX), the HNX-Index increased by 0.54 points, or 0.22 percent, to 241.68 points, with 90 stocks rising, 85 falling, and 74 unchanged.

Market liquidity surged significantly, with the total trading value across the entire market reaching nearly VND38 trillion (over $1.5 billion), of which the Ho Chi Minh City Stock Exchange (HOSE) accounted for nearly VND34.8 trillion (almost $1.4 billion), an increase of VND5.2 trillion compared to the previous session.

Despite domestic investors pouring money into stock purchases, foreign investors persisted in their net selling streak for the 9th consecutive session on the HOSE, with a total net selling value of nearly VND465 billion.