Notably, shares of Novaland Corporation (NVL) experienced a surge, reaching the maximum price increase limit sometime after receiving margin trading approval and 25 creditors agreeing to exchange a debt of VND7 trillion for NVL shares.

On April 5, the stock market extended its third consecutive session of decline as supply surged while demand remained weak. The market continued to sink into the red, with major sectors all experiencing significant drops.

Securities stock group plunged, with HCM reducing by 3.75 percent, VIX dipping by 2.98 percent, SSI sliding by 2.26 percent, VND decreasing by 2 percent, FTS nosediving by 6.73 percent, CTS plummeting by 6.01 percent, ORS falling by 5.33 percent, and ARG slumping by 3.76 percent.

Banking stocks also saw significant decreases, with ACB down by 1.45 percent, CTG by 1.04 percent, BID by 1.57 percent, MBB by 1.89 percent, TCB by 1.74 percent, VIB by 2.16 percent, and MSB by 1.39 percent.

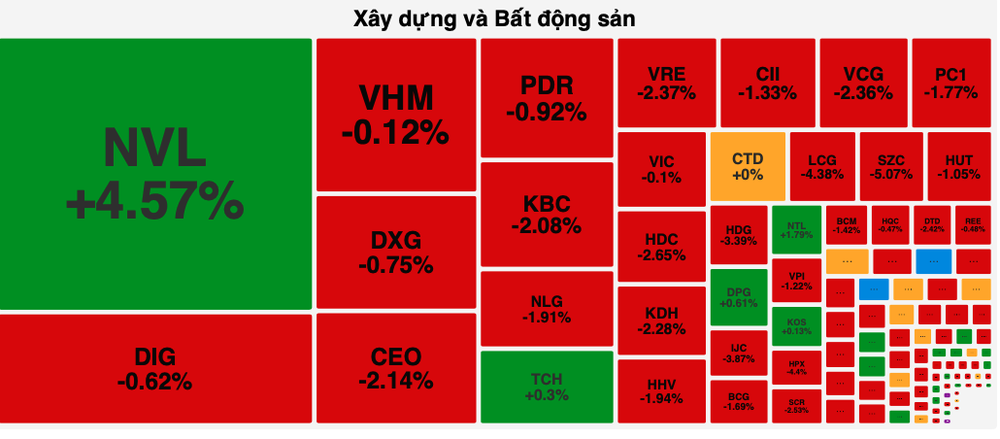

While a few real estate and construction stocks managed to gain ground, most experienced declines. Specifically, NVL escalated by 4.57 percent, NTL climbed by 1.79 percent, and TCH and DPG advanced by nearly 1 percent, while others fell by over 2 percent, including VRE by 2.37 percent, CEO by 2.14 percent, KBC by 2.08 percent, HDC by 2.65 percent, KDH by 2.28 percent, VCG by 2.36 percent, and HDG by 3.39 percent.

Moreover, several large-cap stocks dropped sharply, contributing significantly to the overall market decline. GVR collapsed by 4.83 percent, MSN slashed by 2.04 percent, DCM shrank by 3.11 percent, and DBC fell by 5.71 percent.

At the close of the trading session, the VN-Index deleted 13.14 points, or 1.04 percent, settling at 1,255.11 points. Among the listed stocks, 381 saw a decrease, while 116 saw an increase, and 57 remained unchanged.

Meanwhile, on the Hanoi Stock Exchange, the HNX-Index also lost 2.76 points, or 1.14 percent, reaching 239.68 points, with 106 stocks declining, 61 advancing, and 65 treading water.

Market liquidity improved, with the total trading value on the HOSE surpassing VND25 trillion, marking an increase of about VND1.1 trillion compared to the previous trading session.

Foreign investors continued to be net buyers for the second consecutive session on the HOSE, with a total transaction value of nearly VND145 billion.