|

At the end of the trading session on August 15 in the US, VFS shares of VinFast, an electric car company, closed at $37.06, increasing by 68.4 percent compared to the floor price of $22. The matching volume in the first session reached nearly 6.8 million shares.

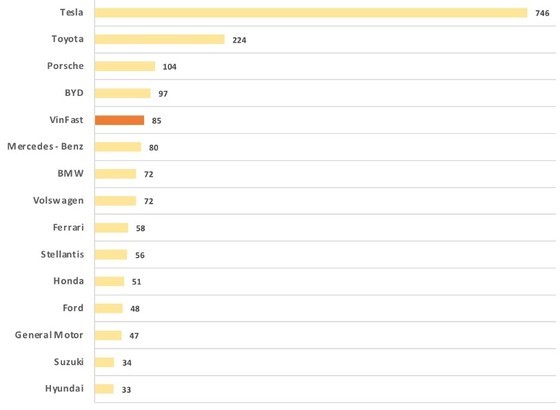

With the above figure, the market capitalization of this electric car company after the first trading session in the US reached US$85.5 billion, 3.7 times higher than the initial valuation of $23 billion, and over 3 times higher compared to the re-valuation after the successful merger with Black Spade.

The startling number of $85.5 billion has also turned VinFast into one of the top 5 car manufacturers with the largest capitalization in the world, surpassing many car giants such as Mercedes - Benz, BMW, Volkswagen, Honda, and Ford.

The listing of VinFast will certainly create a huge breakthrough for Vingroup. The revaluation of investors can have a positive impact on Vingroup because the capital in VinFast alone (51 percent) is worth more than $43 billion, far exceeding the current capitalization of this group, without factoring in the great values of other assets and subsidiaries. According to the method of partial accumulation (SOTP), Vingroup can be considered to be currently undervalued.