|

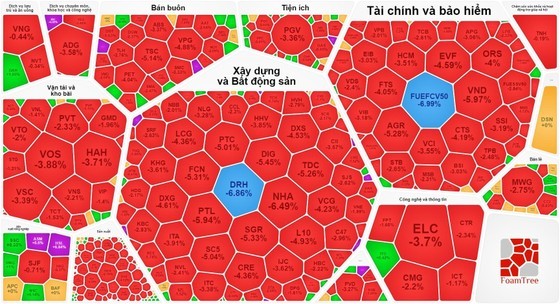

The VN-Index loses nearly 9 points on June 8 due to profit-taking pressure. |

However, the stock of VCB (Vietcombank) has surged to VND100,000 per share, playing a vital role in helping the VN-Index to maintain its milestone of 1,100 points.

The Vietnamese stock market regained a trading volume of over US$1 billion on June 8 after a long period. However, despite five consecutive sessions of gains, the VN-Index reversed its course and experienced a decline due to profit-taking pressure from investors as it approached the resistance level of 1,100 points.

Among them, the real estate stock group, following a previous explosive session, underwent a sharp drop. For example, DIG plunged by 5.45 percent, NVL decreased by 2.41 percent, and DXG fell by 4.61 percent. However, some penny stocks in the real estate sector still reached their ceiling prices, including TDH, LDG, QCG, and TLD.

Furthermore, the financial and banking stock group slumped steeply, with VIB down 3.18 percent, STB down 2.01 percent, VPB down 2.01 percent, CTG down 1.21 percent, BID down 1.47 percent, ACB down 1.14 percent, MBB down 1.72 percent, TCB down 2.61 percent, STB down 2.65 percent, and HDB down 1.58 percent. However, VCB stood out by surging 3.09 percent to reach VND100,000 per share at the end of the session.

The securities stock group also experienced downward trends, with VCI down 3.55 percent, SSI down 3.19 percent, HCM down 3.51 percent, and SHS down 3.15 percent.

The VN-Index dropped by 8.22 points, or 0.74 percent, to close at 1,101.32 points. The market witnessed 269 declining stocks, 139 advancing stocks, and 55 treading water stocks.

Similarly, on the Hanoi Stock Exchange, the HNX-Index sank 3.55 points, or 1.54 percent, closing at 226.78 points, with 115 losers, 83 winners, and 135 unchanged stocks.

Market liquidity rose significantly, with the total trading value across the entire market reaching nearly VND27.2 trillion. Specifically, the Ho Chi Minh City Stock Exchange accounted for approximately VND23.7 trillion, with 1,324 billion shares traded.

Foreign investors continued their strong net selling trend, amounting to nearly VND313 billion.