However, two real estate stocks, QCG from Quoc Cuong Gia Lai Company and LDG from LDG Company, have yet to recover from the downturn. Notably, QCG has been continuously listed on the exchange and requested by the Ho Chi Minh Stock Exchange (HOSE) to provide an explanation.

The stock market in the trading session on July 26 showed signs of recovery, albeit with cautious investor sentiment, resulting in very low liquidity. However, most industry sectors performed well, with the number of rising stocks doubling that of declining stocks.

Despite this positive trend, two real estate stocks, QCG and LDG, have not yet recovered. Specifically, QCG continued to decline, reaching VND6,330 per share on the sixth consecutive day of being listed at the floor price. There are over 6 million shares available for sale at the floor price, with no buyers in sight.

Over the past five trading sessions from July 19 to July 25, the Ho Chi Minh Stock Exchange (HOSE) has requested an explanation from Quoc Cuong Gia Lai Company regarding the continuous decline in QCG’s stock price.

According to the present regulations, companies must report relevant information that may impact stock price fluctuations within 24 hours of a stock reaching its upper or lower limit for five consecutive sessions.

As for LDG stock, it has remained at the floor price for the second consecutive session, trading at VND2,250 per share, with nearly 23.8 million shares available for sale and no buying interest.

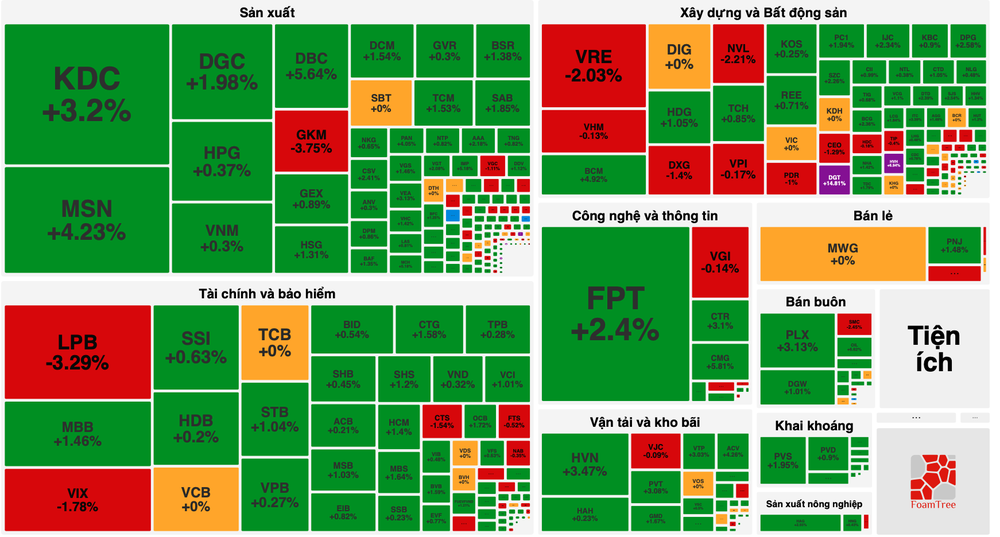

In the real estate and construction sector, several stocks continued to decline. For instance, VRE was down 2.03 percent, NVL 2.21 percent, DXG 1.4 percent, CEO 1.29 percent, and PDR 1 percent. On the other hand, industrial real estate stocks were showing a good recovery. BCM was up 4.92 percent, SZC 2.26 percent, DPG 2.58 percent, CTD and HDG 1.05 percent, and VCG 1.1 percent.

Stocks in the banking sector regained momentum; for example, MBB was up 1.46 percent, CTG 1.58 percent, MSB 1.03 percent, STB 1.04 percent, and OCB 1.72 percent. Additionally, HDB, BID, SHB, ACB, EIB, TPB, and SSB all increased by nearly 1 percent.

Meanwhile, securities companies were also rebounding. HCM was up 1.4 percent, SHS 1.2 percent, and VCI 1.01 percent while SSI and VND saw gains of nearly 1 percent.

In the manufacturing sector, positive trends continued. MSN was up 4.23 percent, KDC up 3.2 percent, DBC up 5.64 percent, DCM up 1.54 percent, DGC up 1.98 percent, and SAB up 1.84 percent.

In addition, several large-cap stocks surged, contributing significantly to the index's recovery. Notably, they included FPT at 2.4 percent, HVN at 3.47 percent, PLX at 3.13 percent, and POW at 5 percent.

At the close of the trading session, the VN-Index gained 8.92 points (0.72 percent) to reach 1,242.11 points, with 284 advancing stocks, 129 declining stocks, and 80 unchanged stocks. On the Hanoi Stock Exchange, the HNX-Index also rose 1.41 points (0.6 percent) to 236.66 points, with 97 gainers, 65 decliners, and 64 unchanged stocks. Liquidity improved but remained at a low level, with the total trading value on HOSE reaching nearly VND11,900 billion, up VND200 billion compared to the previous session.

Foreign investors stopped selling and turned to net buying of nearly VND380 billion on HOSE. The most heavily bought stocks were VCB, BID, MSN, FPT and VNM. Foreign investors spent nearly VND108 billion, VND71 billion and VND67 billion to buy VCB, BID, and MSN respectively.