The stock market in the trading session on April 10 moved downwards due to investors’ risk aversion and hesitation. Additionally, foreign investors resumed heavy selling pressure on the HOSE exchange, exacerbating the overall market situation. However, strong performances from pillar stocks, like VHM, VIC, VRE, and PNJ, helped prevent a sharp decline in the VN-Index.

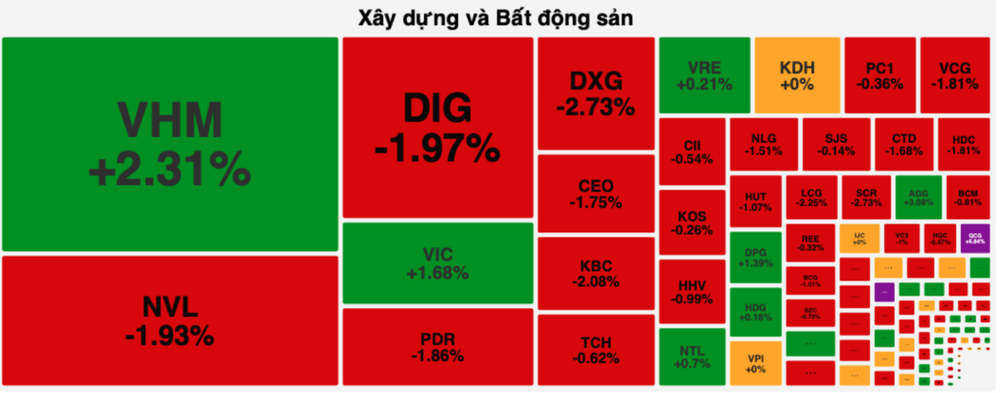

In the real estate and construction stock group, Vingroup's entities performed well, with VHM soaring by 2.31 percent and VIC surging by 1.68 percent. Additionally, VRE saw a nearly 1 percent increase, while DPG rose by 1.39 percent. However, the rest of the stocks in the group experienced steep declines. Specifically, both DXG and SCR collapsed by 2.73 percent, KBC dropped by 2.08 percent, NVL slumped by 1.93 percent, PDR retreated by 1.86 percent, both VCG and HDC demolished by 1.81 percent, and CTD dumped by 1.68 percent.

The banking stock group was also flooded in red. BID suffered a drop of 1.33 percent, CTG lessened by 1.75 percent, TPB diminished by 1.34 percent; MBB, STB, TCB, ACB, MSB, and VIB all saw their values decrease by nearly 1 percent.

The securities group underwent significant declines. VIX subsided by 1.12 percent, HCM dropped by 1.21 percent, SSI slid by 1.47 percent, VCI fell by 1.55 percent, CTS devalued by 1.5 percent, SHS slashed by 1.98 percent, VDS reduced by 2.29 percent, and ORS weakened by 2.13 percent.

Additionally, the oil and gas and manufacturing stocks traded negatively. PVD plunged by 4.22 percent, PVS decreased by 2.12 percent, PVC dived by 3.66 percent, BSR went down by 1.52 percent; MSN sank by 1.36 percent, GEX shrank by 2.51 percent, and GVR evaporated by 2.01 percent.

At the close of the trading session, the VN-Index dipped by 4.26 points, or 0.34 percent, to reach 1,258.56 points, with 275 stocks declining, 177 advancing, and 85 standing still.

Meanwhile, at the Hanoi Stock Exchange, the HNX-Index also fell by 1.57 points, or 0.65 percent, to settle at 238.79 points, with 101 losers, 56 winners, and 72 unchanged stocks.

Market liquidity remained low, with the total trading value on the HOSE reaching VND16.8 trillion, down by VND400 billion compared to the previous session.

Foreign investors resumed net selling on the HOSE, with a total value of nearly VND625 billion.