The stock market experienced a downbeat session on December 31. Trading volume remained low, and foreign investors returned to net-sell on the HOSE exchange, causing the market to lose momentum. By the close, the VN-Index dropped nearly 6 points.

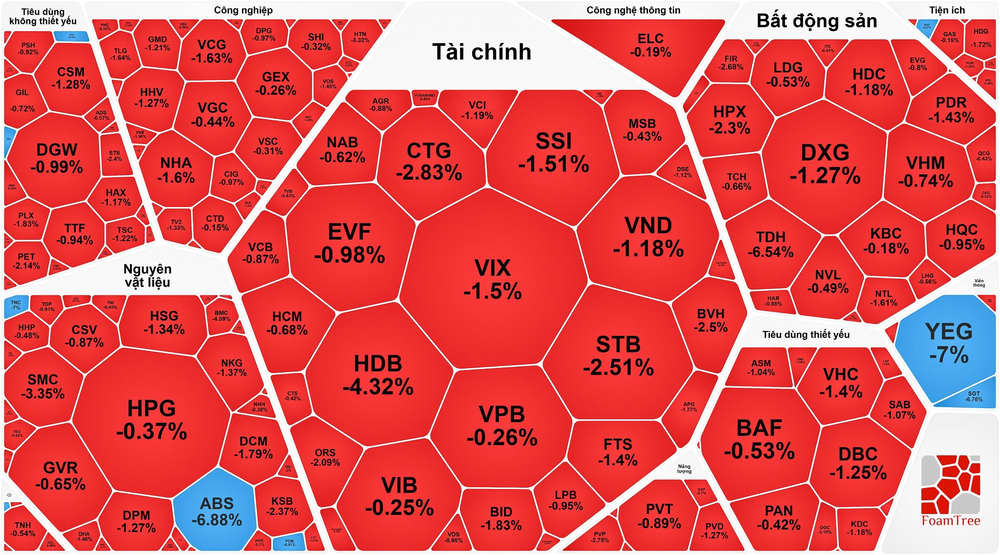

The banking sector saw significant declines, which put pressure on the overall index. Specifically, STB fell 2.51 percent, HDB dropped 4.32 percent, CTG decreased by 2.83 percent, and BID lost 1.82 percent. Other banks like VPB, VCB, NAB, LPB, VIB, and MSB were down around 1 percent. Only a few stocks managed to stay positive, such as OCB with an increase of 3.64 percent, ACB with an increase of 1.57 percent, TCH with an increase of 1.02 percent, and MBB with an increase of 1.21 percent.

The securities sector also saw losses, with VIX down 1.5 percent, VND down 1.18 percent, VCI down 1.19 percent, FTS down 1.4 percent, SSI down 1.51 percent, ORS down 2.09 percent, and MBS down 1.38 percent.

In the real estate sector, DXG tumbled 1.27 percent, PDR devalued 1.43 percent, CEO declined 1.49 percent, NTL collapsed 1.61 percent, and HDC sank 1.18 percent. Stocks like VHM, KDH, KBC, NVL, IDC, and TCH also saw nearly 1 percent drops.

The steel sector was also in the red, with HSG melting by 1.34 percent, NKG shrinking by 1.37 percent, and HPG weakening by nearly 1 percent.

The telecom sector stood out, going against the market trend: DST hit its ceiling, CTR rose 1.22 percent, VGI gained 1.21 percent, FOX increased by 2 percent, and TTN jumped by 3.56 percent. Meanwhile, Yeah1 Group’s stock (YEG) dropped to its floor price of VND18,600 per share, with more than 2 million shares being sold and no buyers. Previously, the stock had been rescued from the floor after two consecutive losing sessions, following a seven-session ceiling rise. The HOSE had requested an explanation for this unusual increase.

At the close, the VN-Index dropped 5.24 points, or 0.41 percent, to 1,266.78 points, with 254 stocks declining, 155 rising, and 79 unchanged.

On the Hanoi Stock Exchange (HNX), the HNX-Index also retreated by 0.71 points, or 0.31 percent, to 227.43 points, with 80 stocks declining, 76 rising, and 69 unchanged. Liquidity remained low, with the total trading value on the HOSE at nearly VND11.6 trillion.

After two previous sessions of net buying, foreign investors returned to net-sell nearly VND302 billion on HOSE. The top three stocks with the largest net sell-offs were VCB with a worth of VND132 billion, BID with a worth of VND73 billion, and STB with a worth of VND70 billion.