|

SSC recommends investors should beware of fake news when investing in stocks |

According to SSC, investors should not only beware of false rumors without verification which will greatly affect their investment decisions but also analyze and comprehensively evaluate macroeconomic factors, production and business activities of enterprises as well as receive official information from enterprises.

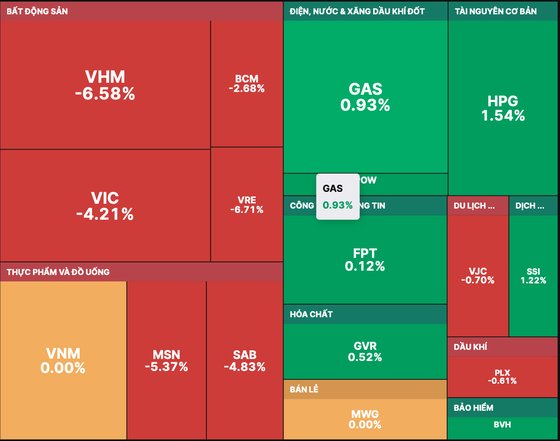

After the previous day's plunge, today’s stock market showed signs of recovery without a strong fall. Moreover, the main stock groups also recovered well. However, the Vingroup trio still dropped sharply, putting pressure on the index.

After the index fell by more than 4 percent on October 26, SSC today affirmed that the stock market is maintaining stable operations as well as it recommended that investors need to view and comprehensively evaluate the macro economy because although share prices have gone up and down under the combined impact of many factors, the stock market still shows stability through improvements in liquidity as well as gradually increasing number of new accounts.

A representative from the State Securities Commission also added that market developments are influenced by many domestic and world macro factors such as inflation, tightening monetary policies in many countries, and pressure on exchange rate management. In addition, many large economies, including important trading partners of Vietnam, have slowed down, affecting Vietnam's import and export activities.

However, the Government and ministries, agencies and local administrations have made many efforts to remove difficulties for businesses and people for promotion of economic growth, improvement of the investment environment, along with lowering interest rates with the aim to support production and business activities.

The domestic stock market is expected to maintain positive liquidity and to be an attractive investment channel for investors.

SSC representative also affirmed that responsible agencies will closely monitor all unusual transactions while checking deeds that have shown signs of profiteering. It will coordinate with competent agencies to issue tough penalties on those who spread false and fake rumors in the market, causing negative effects on investors’ investment decisions in the stock market.

After the previous day's plunge, the stock market on the morning of October 27 showed signs of recovery, no longer having a strong fall and the main stock groups also recovered well.

Specifically, the real estate group has a number of stocks in the green. For instance, CTD increased by 5.85 percent, DIG rose by 2.53 percent, DXG surged by 2.45 percent, IDC increased by nearly 1 percent, HDC increased by 2.51 percent. However, although VIC and VHM have no longer been at the floor price - the minimum price (lower level) at which bids can be made for an IPO, the trio of Vingroup still fell deeply with VHM down 6.58 percent, VIC down 4.21 percent and VRE down 6.67 percent causing pressure on index.

Many securities stocks also recovered positively namely OGC climbing 2.61 percent, SHS increasing 2.04 percent, VDS increasing 2.19 percent, VCI soaring 2.35 percent, SSI escalating 1.22 percent.

The banking stocks also saw a good increase, helping to slow down the market's decline. For instance, LPB, MSB, ACB, and MBB increased 6.29 percent, 2.46 percent, 1.9 percent, 1.16 percent respectively.

At this morning’s closing session, VN-Index decreased 5.9 points (0.56 percent ) to 1,049.55 points with 232 codes decreasing, 185 codes increasing and 77 codes remaining unchanged.

On the contrary, at the morning’s closing session on the Hanoi floor, HNX-Index increased slightly by 0.82 points (0.38 percent) to stand at 215.8 points with 72 codes increasing, 66 codes decreasing and 58 codes remaining unchanged.

Liquidity decreased while the total trading value on HOSE in the morning session was only about VND 5,300 billion (US$217,626,598). Foreign investors continued to net sell the trio of Vingroup. Net selling prices of VRE, VHM, and VIC was nearly VND 54.8 billion, nearly VND37.8 billion and nearly VND23.3 billion respectively.