While there is broad recognition that, in the long term, a comprehensive revision of both the Special Consumption Tax and the Environmental Protection Tax is necessary to establish a rational and internationally aligned taxation framework for gasoline, the imposition of a special consumption tax on this fuel remains essential in the current context.

As part of proposed legislative amendments, the draft law also introduces exemptions from the tax for certain categories of vehicles. Specifically, aircraft, helicopters, and gliders used for emergency medical services, search and rescue operations, and agricultural production will be excluded from the taxable scope.

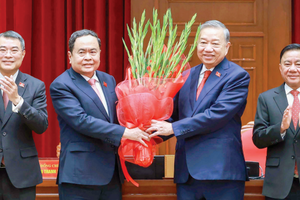

On the morning of June 14, as part of its ongoing ninth session of the 15th National Assembly (NA) in Hanoi, the National Assembly passed the amended Law on Special Consumption Tax with 448 out of 454 deputies present voting in favor, accounting for 93.72 percent of the total membership of the National Assembly.

Chairman of the National Assembly's Economic and Finance Commission, Phan Van Mai, stated that the National Assembly Standing Committee has agreed with the drafting agency’s proposal to apply the Special Consumption Tax to air conditioners with a capacity ranging from over 24,000 BTU to 90,000 BTU. Under the revised law, air conditioners with a capacity of 24,000 BTU or less, as well as those exceeding 90,000 BTU, will not be subject to the tax.

Under the draft amended Law on Special Consumption Tax, sugar-sweetened beverages to taxation are defined as products containing more than 5 grams of sugar per 100 milliliters.

Milk and dairy-based products; liquid foods intended for nutritional purposes; natural mineral water and bottled drinking water; pure vegetable and fruit juices; fruit and vegetable nectar; and cocoa-based products; items like natural fruit juices, coconut water, dairy products, and medically purposed liquid nutritional supplements will not be subject to the Special Consumption Tax.