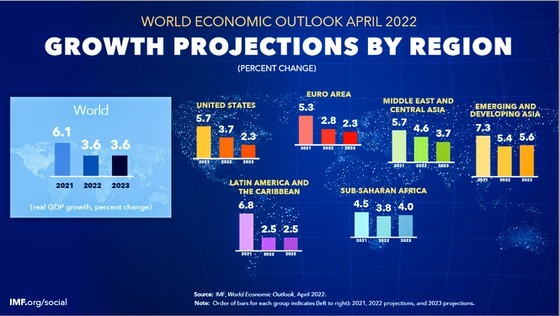

The growth forecast of the global economy in 2022 and 2023 is much less optimistic than in 2021

The growth forecast of the global economy in 2022 and 2023 is much less optimistic than in 2021

Worry of recession

During the first week of May 2022, the US Federal Reserve (FED) raised interest rate by 0.5% and began to shrink its balance sheet. The US Federal Reserve has allowed expanding to around US$9,000 bn, compared to before the Covid-19 pandemic outbreak. With such an unprecedented increase, there is no book or guide as to how the FED can collect money in an orderly manner. Especially when the FED does not have much time because inflation in the US is continuing to reach new peaks, so it must find a way to cool down this current rising inflation at the earliest.

Excessive money injected along with rising inflation, which has remained high and lasted longer than expected, has become a duo factor that is raising interest rates and shrinking balance sheets at a faster rate. However, the FED has another very important goal to balance with, which is how to raise interest rates and shrink the balance sheet without causing a recession. This is what some experts call a growth scare.

The fear factor of slow growth and an impending recession is gradually becoming a bigger worry than the fear of high inflation. Signs of recession in the global economy have begun to appear more often, as indicated in the commentary in Financial Times and the Economist. The recession worries many banks and hedge funds, but inflation is not much of an immediate concern. While the news in the financial media in early May 2022 discussed a lot about the FED decision to raise interest rate by 0.5 percent and shrink the balance sheet, the market strategy reports of many banks have stopped talking about this factor but are now more focused on recession risks and credit risks.

Goldman Sachs estimates that the recession risk to the US economy will be about 35 percent. If the US manages to avoid the impending recession risk, its economy will still face the risk of credit default.

Landing in the fog

Nonetheless, the US is still in a better shape than the U.K. The Bank of England is in a more difficult situation than the FED with inflation set to skyrocket. U.K. now must run after inflation but cannot raise interest rates too quickly for fear of causing disruption within their economy. Mr. Andrew Bailey, Governor of the Bank of England, admits it is not a good situation right now for raising interest rates, although they still must tighten the currency, otherwise excess liquidity in the economy could worsen inflation.

The Bank of England is facing a very difficult problem at present. This is to say, it needs to raise interest rates to continue tightening its monetary policy but without pushing the economy into a recession. The prediction is that real GDP growth will decline by 1 percent in the fourth quarter of 2022 if energy prices increase by 40 percent. In this scenario, inflation could hit more than 10 percent by the fourth quarter of 2022, a 40-year high, and reduce real household incomes, because wages will not be able to keep up with such high inflation.

Hard lessons from China

In May 2022, the Central Bank of China (PBoC) cut the Five-Year Loan Interest Rate by a large level of 15 basic points compared to the expected upto 10bp rate. This is one of the many changes in the country's monetary policy. At the same time, the country's bond market regulator also allowed the application of CSIPB products, a type of bond issued with derivatives, to insure against default. This is a reversal sign in the decision to tighten credit sources in the economy, especially in the real estate sector.

According to Caixin Global, this is a move like Shanghai and Shenzhen's efforts last month to support capital-hungry property developers, enabling them to sell bonds to raise capital and alleviate the financial crisis situation of this industry. According to the first quarter report of 2022, the net mobilized capital inflow from private bonds is negative yuan of 2 bn, about $297 mn, meaning that companies are paying out more than they've raised as they struggle with liquidity problems, shrinking funds, and falling demand for real estate.

However, the near-term outlook for China's property market remains uncertain, leaving analysts questioning whether these belated support factors will work. Goldman Sachs recently raised its forecast for the default rate for China's real estate industry to 31.6 percent, nearly double the previous figure of 19 percent. Daily real estate transaction volumes across 30 major Chinese cities in May fell by as much as 50 percent year-on-year.

This can be seen because of the hasty tightening of the real estate market in China. Although the purpose of this policy of correcting the real estate market is good, the large scale of the real estate industry in the Chinese economy makes the tightening of credit for this sector show more serious bigger consequences than imagined. Especially in the context of the complicated development of the Covid-19 pandemic, it was difficult for the Chinese economy to achieve growth above 5 percent as expected, posing the risk of credit default for some businesses because their income sources are not enough to pay their debts.

Implications for Vietnam

Although the current situation is still not very clear yet, there are signs that the economies of both Japan and South Korea have begun to take a hit and some exporters in Asia have faced cuts in export orders when the recent US ISM Purchasing Managers Index (PMI) data fell for a second straight month to 55.4 compared to market forecasts of 57.6. The key issue right now is right timing because there are so many uncertain factors due to slowdown in production, new orders and unemployment.

The fact remains that no one can predict Russia’s next move in Ukraine, further development of hostilities, and the size of sanctions inflicted by Western nations, which all will affect the price of oil. Predictions made in 2021 about oil prices touching $60 or $70 per barrel by the end of 2022 proved quite wrong. The current predictions that the labor market and supply chains will return back to normal in 2022 have also faltered in advanced economies.

In the current unpredictable situation, it is imperative for Central Banks in developed countries to raise interest rates or tighten monetary policy. Earlier these countries had loosened monetary policy during the Covid-19 pandemic to support the economy. However, raising interest rates too strongly will not help much in controlling inflation in this situation, because rising interest rates will not create more food or lower food prices, as stated by Professor Joseph Eugene Stiglitz.

On the other hand, China's tightening of credit supply to fight an asset bubble is also very important. Interest rate hikes and monetary tightening are needed to keep asset bubbles from getting too big and keeping them within moderation. The actions of China were made in haste to cool down the real estate market, but this has left obvious consequences that now pumping money out has not shown any signs of being absorbed, and it may take many more months for this pumped out money to take effect.

If Professor Joseph Eugene Stiglitz says that raising interest rates will not solve the inflation problem because this does not create more food sources, then we have a similar comparison in cutting credit to real estate which will not solve the price problem. Housing in big cities is too high compared to the income of a majority of people because it does not increase the supply of houses for people who need to buy homes to live in.

The problem of cooling down the real estate fever as well as the excessive borrowing of businesses in the economy, whether through the bond or credit market, also needs to be carried out according to a roadmap suitable to the tolerance of the economy. It is impossible to solve a problem with three goals at the same time, namely, fighting inflation, limiting excessive borrowing to speculate on assets, and avoiding a recession.

Killing the economy with excessive credit tightening will not solve inflation or curb the real estate investment boom, but it can drag the economy into a long and costly recession which will be very hard to get out of for a long period of time.