|

Notably, the real estate and construction sector exhibited a broad surge, with many stocks showing significant breakthroughs.

The stock market trading session on November 16 was also a derivatives maturity session, impacting investor psychology and resulting in a sharp decrease in liquidity. Throughout most of the session, the VN-Index experienced a decline. However, in the last minutes of the session, the market saw a rebound, leading to a nearly 4-point increase in the VN-Index.

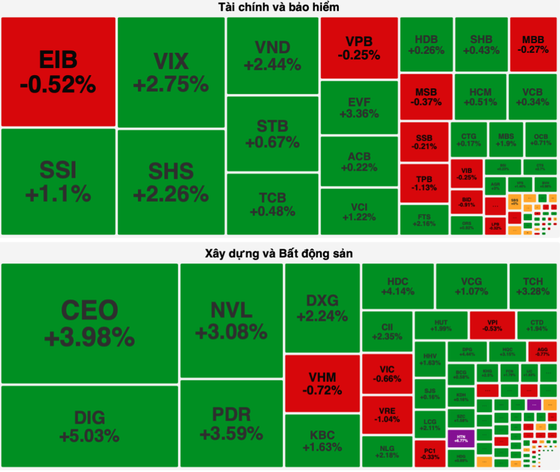

The real estate and construction stock group displayed resilience right from the start as it collectively embraced an upward trend, defying a substantial decline in liquidity. Notably, several stocks experienced robust gains, with DIG soaring by 5.03 percent, HDC by 4.14 percent, PDR by 3.59 percent, TCH by 3.28 percent, NVL by 3.08 percent, DXS by 2.24 percent, NLG by 2.18 percent, DXG by 2.01 percent, IDC and KBC by 1.63 percent, and SZC by 1.58 percent. However, the trio of Vingroup's stocks - VHM, VIC, and VRE - experienced a slight dip, hovering around 1 percent.

Besides the real estate group, the securities stock category also demonstrated positive performance, with AGR gaining 3 percent, VIX rising by 2.75 percent, VND increasing by 2.44 percent, CTS advancing by 2.7 percent, SHS climbing by 2.26 percent, FTS growing by 2.16 percent, MBS edging up by 1.9 percent, OGC moving up by 1.7 percent, VCI adding up by 1.22 percent, and SSI shooting up by 1.1 percent.

The banking stock group exhibited some divergence but remained within a narrow range. Specifically, TPB dropped by 1.13 percent; SSB, MSB, MBB, LPB, EIB, and BID slid by nearly 1 percent. On the contrary, VCB, ACB, CTG, HDB, SHB, OCB, SCB, and TCB rallied by nearly 1 percent.

By the end of the trading session, the VN-Index inched up by 3.03 points, or 0.27 percent, to reach 1,125 points, with 218 winners, 280 losers, and 100 unchanged stocks.

The HNX-Index on the Hanoi Stock Exchange closed with a rise of 1.69 points, or 0.74 percent, at 229.57 points, with 94 advancing, 66 declining, and 59 unchanged stocks.

Market liquidity experienced a sharp drop, with the total trading value across the entire market reaching around VND17.6 trillion, marking a reduction of nearly VND5 trillion compared to the previous session.

Following a brief period of net buying in the previous session, foreign investors continued to engage in net selling, with a total value of nearly VND121 billion on the HOSE exchange.