|

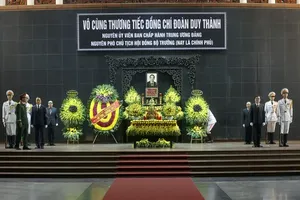

A plenary session of the 15th NA's fifth sitting (Photo: VNA) |

This is part of the resolution of the NA’s fifth session that received support from 481 of the 482 deputies casting votes on June 24 afternoon.

Earlier, Secretary General of the NA and Chairman of the NA Office Bui Van Cuong had delivered a report explaining and presenting revisions to the draft resolution, which was sent to legislators on June 21 to seek their feedback.

He said that some deputies recommended expanding the coverage of the VAT cut to all groups of goods and services currently subject to the tax rate of 10 percent; raising the reduction level to 3 percent, 4 percent or 5 percent; and extending the policy until mid-2024 or the end of that year.

However, the NA Standing Committee held that if the coverage and level of the VAT reduction are further expanded, the state budget collection will be greatly affected. Meanwhile, the Government hasn’t fully assessed this policy’s impacts, especially amid the budget revenue decline during the first months of 2023 compared to the same period last year.

Therefore, the NA Standing Committee wished to propose the NA maintain the coverage and level of the tax cut, Cuong noted.

Also on June 24, the parliament adopted a resolution on the activity of questioning at its fifth session.

During the fifth session, the NA approved eight laws and 17 resolutions, gave opinions for the second time on the draft revised Land Law, and debated eight draft laws for the first time.