The VN-Index recovers thanks to blue-chip stocks on October 25. (Photo: SGGP)

The VN-Index recovers thanks to blue-chip stocks on October 25. (Photo: SGGP)

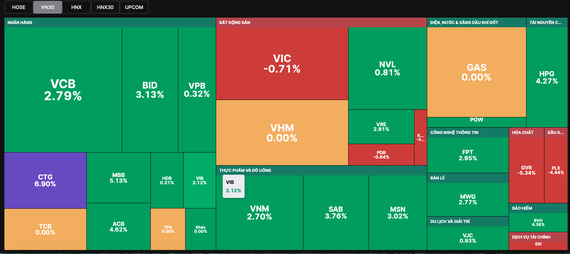

The SBV's decision to raise the operating interest rates as of October 25 seemed to have been reflected in the price after a sharp drop in the previous trading session, so banking stocks gained quite well in the morning trading session. Specifically, BID and SHB hit the ceiling; CTG jumped by 6.67 percent; STB rose by nearly 5 percent; VCB edged up by 1.32 percent; ACB soared by 5.6 percent; MBB escalated by 5.1 percent.

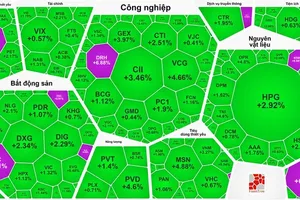

Besides banking stocks, contributing greatly to the strong recovery of the VN-Index were blue-chip stocks, such as VNM with an increase of 3.38 percent, SAB with 3.92 percent, and HPG with 4.57 percent.

Securities stocks also reversed to increase sharply, such as HCM with 4.9 percent and VCI with 4.3 percent. VND alone only decreased by 2.8 percent from hitting the floor price.

However, real estate stocks could not recover because of a lot of negative information in the market, especially information related to corporate bonds, so many stocks in this group still dropped sharply, such as VIC with an increase of 3.36 percent, VHM with 1.12 percent, NVL with 1.21 percent, KBC with 5.01 percent, and DIG with 5.47 percent.

Closing the morning trading session, the VN-Index gained 11.55 points, or 1.17 percent, to 997.7 points, with 177 gainers and 247 losers. Thus, in the morning, the VN-Index recovered nearly 36 points from the lowest level of 962 points to 997.7 points. In contrast, the HNX-Index fell 0.25 points, or 0.12 percent, to 209.26 points, with 48 gainers and 119 losers.

The market recovered thanks to good bottom-fishing demand, so the liquidity in the morning trading session surged by more than 50 percent compared to the previous one, with a total trading value of about VND6.3 trillion.

With the bullish sentiment in the morning trading session, the market in the afternoon trading session continued to advance robustly, with the VN-Index sometimes surpassing 1,000 points. However, after that, the selling pressure increased, and the market shook strongly, the VN-Index dropped from an increase of 16 points to 5-6 points below reference before recovering again at the end of the session.

Some stocks in the steel, fertilizer, and retail sectors still maintained strong gains throughout the session. Specifically, DCM, DPM, and HSG hit the ceiling; FRT rallied by 3.36 percent; VRE emerged by 2.91 percent; DGW surged by 5.6 percent.

Besides CTG, LPB, and SHB, which still kept the ceiling price, many other banking stocks no longer maintained the ceiling price. For instance, BID closed the session with an increase of only 3.1 percent; MBB climbed by 5.1 percent; ACB gained by 4.6 percent; STB only inched up 0.3 percent.

Similarly, many securities stocks also lost rising momentum. Specifically, VCI only shot up by 1.3 percent; SHS grew by 2.9 percent; HCM strengthened by 3.8 percent.

Closing the trading session, the VN-Index grew by nearly 12 points, or 1.17 percent, to 997.7 points, with 199 gainers, 247 losers, and 75 unchanged stocks.

Meanwhile, the HNX-Index decreased slightly by 1.48 points, or 0.71 percent, to 208.02 points, with 56 gainers, 128 losers, and 44 unchanged stocks.

Market liquidity remained at a fairly good level, with the total trading value at nearly VND14 trillion. Foreign investors also returned to net sell roughly VND89 billion in the whole market.

Besides banking stocks, contributing greatly to the strong recovery of the VN-Index were blue-chip stocks, such as VNM with an increase of 3.38 percent, SAB with 3.92 percent, and HPG with 4.57 percent.

Securities stocks also reversed to increase sharply, such as HCM with 4.9 percent and VCI with 4.3 percent. VND alone only decreased by 2.8 percent from hitting the floor price.

However, real estate stocks could not recover because of a lot of negative information in the market, especially information related to corporate bonds, so many stocks in this group still dropped sharply, such as VIC with an increase of 3.36 percent, VHM with 1.12 percent, NVL with 1.21 percent, KBC with 5.01 percent, and DIG with 5.47 percent.

Closing the morning trading session, the VN-Index gained 11.55 points, or 1.17 percent, to 997.7 points, with 177 gainers and 247 losers. Thus, in the morning, the VN-Index recovered nearly 36 points from the lowest level of 962 points to 997.7 points. In contrast, the HNX-Index fell 0.25 points, or 0.12 percent, to 209.26 points, with 48 gainers and 119 losers.

The market recovered thanks to good bottom-fishing demand, so the liquidity in the morning trading session surged by more than 50 percent compared to the previous one, with a total trading value of about VND6.3 trillion.

With the bullish sentiment in the morning trading session, the market in the afternoon trading session continued to advance robustly, with the VN-Index sometimes surpassing 1,000 points. However, after that, the selling pressure increased, and the market shook strongly, the VN-Index dropped from an increase of 16 points to 5-6 points below reference before recovering again at the end of the session.

Some stocks in the steel, fertilizer, and retail sectors still maintained strong gains throughout the session. Specifically, DCM, DPM, and HSG hit the ceiling; FRT rallied by 3.36 percent; VRE emerged by 2.91 percent; DGW surged by 5.6 percent.

Besides CTG, LPB, and SHB, which still kept the ceiling price, many other banking stocks no longer maintained the ceiling price. For instance, BID closed the session with an increase of only 3.1 percent; MBB climbed by 5.1 percent; ACB gained by 4.6 percent; STB only inched up 0.3 percent.

Similarly, many securities stocks also lost rising momentum. Specifically, VCI only shot up by 1.3 percent; SHS grew by 2.9 percent; HCM strengthened by 3.8 percent.

Closing the trading session, the VN-Index grew by nearly 12 points, or 1.17 percent, to 997.7 points, with 199 gainers, 247 losers, and 75 unchanged stocks.

Meanwhile, the HNX-Index decreased slightly by 1.48 points, or 0.71 percent, to 208.02 points, with 56 gainers, 128 losers, and 44 unchanged stocks.

Market liquidity remained at a fairly good level, with the total trading value at nearly VND14 trillion. Foreign investors also returned to net sell roughly VND89 billion in the whole market.