|

The market’s benchmark on the Ho Chi Minh City Stock Exchange (HoSE) tumbled 14.79 points, or 1.39 percent, to 1,047.4 points. It erased more than half of Wednesday’s gain and set for a weekly loss due to weaker appetite for risk assets after the recent collapses of two American banks.

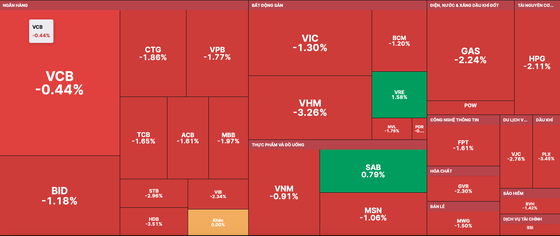

The breadth of the market was negative with 285 stocks going down, while 50 ticker symbols advanced.

Liquidity also declined. Specifically, a trading value on the southern bourse fell 12.1 percent over the previous session to more than VND9.4 trillion (US$399 million), equal to a trading volume of over 532.9 million shares.

The VN30-index, which tracks the 30 biggest stocks on HoSE, also retreated to 1,046.99 points, a decline of 17.39 points, or 1.36 percent. In the VN30 basket, up to 27 stocks finished lower, two increased and one was flat.

Stronger selling pressure in the last trading minutes weighed on the market.

In the top three stocks dominating the market’s downward trend, Vinhomes (VHM) was the biggest loser with a fall of 3.26 percent in market capitalization. The other two names were PV Gas (GAS) and BIDV (BID), down 2.24 percent and 1.18 percent, respectively.

Also contributing to the general losses, the market’s influencers like Vingroup (VIC), Vietinbank (CTG), Hoa Phat Group (HPG), VPBank (VPB), Vietcombank (VCB), Petrolimex (PLX), HDBank (HDB), Vietnam Rubber Group (GVR), Masan Group (MSN), FPT Corporation (FPT), and Mobile World Investment Corporation (MWG), posted losses of at least 1 percent.

Cushioning some of the losses, Vincom Retail (VRE) and Sabeco (SAB) led the uptrend with gains of 1.58 percent and 0.79 percent, respectively.

On the Hanoi Stock Exchange (HNX), the HNX-Index also resumed the recent downtrend after jumping 4.46 points on Wednesday.

The northern market’s benchmark settled Thursday at 204.19 points, down 2.82 points, or 1.36 percent.

During the session, nearly 52.7 million shares were traded on HNX, worth VND813.04 billion.

On the other hand, foreign investors continued their long streak of net-buying with a value of VND87.25 billion on both main exchanges. Particularly, they net bought VND89.36 billion on HoSE, while net selling VND2.11 billion on HNX.