|

Vietnam's stock market is flooded in red as investors dump shares heavily. |

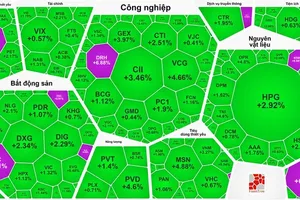

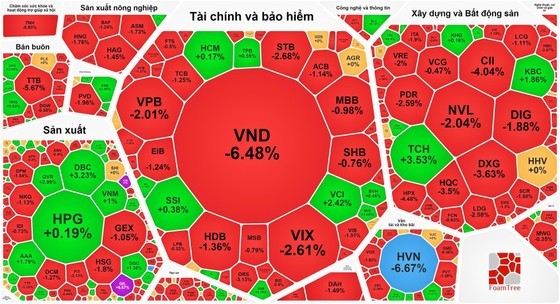

On July 6, the Vietnamese stock market experienced strong selling pressure from investors, leading to a widespread decline in stock prices. Foreign investors, in particular, continued to sell a net amount of nearly VND314 billion on the HOSE exchange.

One of the factors negatively impacting the market and leading to a broad slump is the strong sell-off of VND stocks of VNDirect Securities Corporation, reaching a record high volume of nearly 106 million units, causing the stock to hit the floor at one point. Despite recovering from the lower circuit by the session close, VND still experienced a 6.5 percent decline, settling at VND18,050 per share.

Additionally, HVN shares of Vietnam Airlines were also dumped by investors, leading to a sharp drop to VND13,300 per share, with no buying activity. It was due to HOSE's recent decision to transfer HVN shares from the "under supervision" category to the "trading restriction" category starting from July 12, 2023. The decision was a result of Vietnam Airlines' delay in submitting audited financial reports for the year 2022, surpassing the prescribed deadline by more than 45 days.

Major banking stocks witnessed substantial declines, ranging from 1 percent to almost 3 percent, which played a role in the significant decrease of the VN-Index. The affected stocks included VCB, VPB, STB, MBB, TCB, VIB, ACB, and HDB.

Numerous construction and real estate stocks experienced drops ranging from 2 percent to 6 percent, including PDR, DIG, NLG, CII, QCG, EVG, TGG, LGL, HPX, CIG, PTL, and TTB.

Besides VND, several other securities stocks were also flooded in red. However, a few exceptional securities stocks managed to maintain their positive performance, including SSI, VCI, MBS, HCM, and BSI. Among them, VCI stood out with a 2.4 percent increase.

At the end of the trading session, the VN-Index fell by 8.4 points, or 0.74 percent, to reach 1,126 points, with 339 stocks decreasing, 94 stocks increasing, and 75 stocks remaining unchanged.

Similarly, the HNX-Index at the Hanoi Stock Exchange (HNX) also dropped by 2.76 points, or 1.21 percent, with 138 stocks retreating, 44 stocks advancing, and 150 stocks standing still.

The market saw a significant increase in liquidity, with the total trading value reaching nearly VND21.19 trillion.