|

Notably, over VND1.5 trillion was pumped into NVL (Novaland) shares, leading the stock to hit the daily trading ceiling with an outstanding demand of more than 4.5 million shares by the session's close.

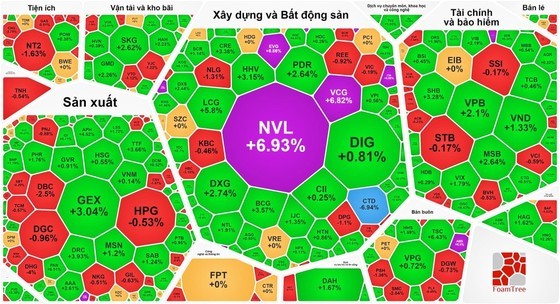

On July 24, the Vietnamese stock market witnessed a robust surge as the cash flow continued to pour into the market, resulting in sustained high liquidity levels. Construction and real estate investment stocks dominated the market during the trading session, with NVL stock standing out. NVL attracted an impressive investment of over VND1.5 trillion, propelling the stock to reach the daily trading ceiling and concluding the session with an excess demand of more than 4.5 million shares.

In addition to NVL, several real estate and construction stocks, including companies in the infrastructure investment group, also recorded significant gains. ITA, VCG, PHC, CC1, and HAN stocks all hit their daily trading limit, while PDR surged by 2.64 percent, DXS climbed by 2.33 percent, LDG escalated by 6.36 percent, KDH rose by 4.26 percent, DXG appreciated by 2.74 percent, HHV grew by 3.15 percent, SJS advanced by 2.42 percent, CRE increased by 3.38 percent, TCD augmented by 4.77 percent, and QCG went up by 3.65 percent.

Moreover, the upward trend expanded to different stock categories, including banking. Specifically, VPB climbed by 2.1 percent, VIB scaled by 2.19 percent, SHB rose by 3.28 percent, and MSB increased by 2.64 percent. In the securities group, TVS reached the trading ceiling, while CTS strengthened by 3.3 percent, SHS advanced by 3.4 percent, ORS grew by 2 percent, VIX appreciated by 1.8 percent, and VND rallied by 1.3 percent.

At the end of the trading session, the VN-Index experienced a gain of 4.82 points, or 0.41 percent, reaching 1,190.72 points. Among the listed stocks, 301 showed an increase, 154 declined, and 71 remained unchanged.

At the closing bell on the Hanoi Stock Exchange, the HNX-Index also rose by 1.55 points, or 0.66 percent, to 236.53 points, with 106 stocks recording gains, 76 stocks retreating, and 72 stocks remaining unchanged.

Market liquidity remains high, with the total trading value across the entire market reaching nearly VND23.2 trillion, out of which the HOSE (Ho Chi Minh Stock Exchange) accounted for over VND20 trillion. Foreign investors continued to be net sellers, with a net selling value of over VND330 billion on the HOSE.