Innovative startups are eagerly awaiting the Ho Chi Minh City Venture Capital Fund to become operational soon, not only to resolve the capital bottleneck but also to contribute to the goal of the Ho Chi Minh City innovation startup ecosystem reaching the top 100 most dynamic cities globally by 2030, as stated at the 2025 National Innovation Startup Ecosystem Development Conference.

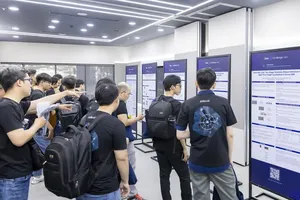

In 2025, Ho Chi Minh City’s innovation startup ecosystem was recognized as large-scale, diverse, and rapidly evolving. The city is currently home to around 2,000 startups, with strong concentrations in artificial intelligence, e-commerce, fintech, and agricultural technology.

Ho Chi Minh City’s startup ecosystem has entered the global top 110 and, for the first time, ranked among the top five in Southeast Asia. The city now attracts around 50 percent of Vietnam’s startups, 40 percent of incubation facilities, and 44 percent of investment capital, with its innovation ecosystem valued at an estimated US$7.5 billion. Building on this achievement, Ho Chi Minh City has set a target of reaching the global top 100 most dynamic cities by 2030, based on three key pillars: improving startup support policies, investing in infrastructure, and developing high-quality human resources.

Responding to the urgent need to ease capital bottlenecks for innovation and to implement major directives from the central government and the city, the Ho Chi Minh City Department of Science and Technology has finalized the proposal to establish the Ho Chi Minh City Venture Capital Fund by the end of 2025. The fund is expected to begin operations in 2026, providing support for technology startups and advancing the city’s goals in science, technology, and innovation development under the Politburo's Resolution No. 57-NQ/TW.

The Ho Chi Minh City Venture Capital Fund will operate under a public-private partnership model, with 60 percent of its charter capital coming from the private sector and 40 percent from the State. Public funds will be released only after private contributions are secured, ensuring market discipline and maximizing state capital’s impact. Launching in 2026 with VND500 billion, the fund is expected to grow tenfold to VND5,000 billion by 2035.

Over the next decade, it aims to back around 50–150 startups, help commercialize at least 50 products and technologies, and nurture 5–10 major tech firms capable of IPOs, mergers and acquisitions, or international expansion.

According to the Ho Chi Minh City Department of Science and Technology, the city will focus on developing four models of innovation and startup centers including a national-level innovation center, the Ho Chi Minh City High-Tech Park, the Ho Chi Minh City Innovation and Startup Support Center (SIHUB), and a public-private partnership (PPP) model. These centers are identified as the core connecting research, incubation, technology commercialization, and venture capital flows.

The fund focuses on innovative startups, science and technology enterprises, and digital technology industrial enterprises that are legally established and operating in Vietnam, have innovative products, and are committed to operating in Ho Chi Minh City for at least 5 years. According to experts, to operate effectively, the fund should not prioritize short-term capital preservation but rather act as "seed capital," supporting startups, especially in the early stages, which are a high-risk but crucial period for breakthrough success.