During the 43rd session of the Standing Committee of the National Assembly, Mr. Phan Van Mai, Chairman of the National Assembly's Finance and Budget Committee, presented a report on the revisions and finalization of the draft amended Special Consumption Tax Law on the afternoon of March 10.

Regarding tax rates, Mr. Phan Van Mai stated that the NA’s Finance and Budget Committee supports taxing sugary beverages, a newly proposed category, at a reasonable rate to gradually reduce high-sugar product consumption and encourage businesses to produce lower-sugar alternatives.

"In response to feedback from NA deputies, we propose delaying the tax implementation for this product by one to two years beyond the draft law’s initial timeline or applying a phased approach. This would still achieve the policy’s objectives while allowing businesses more time to adjust their production and business strategies," Mr. Phan Van Mai noted.

The reviewing agency agreed with the drafting committee’s proposal to impose a 10-percent tax rate on sugary beverages to encourage businesses to produce lower-sugar drinks and raise consumer awareness. After a period of implementation, the policy will be reviewed and adjusted based on practical experience and international practices.

Regarding pick-up trucks used for cargo transport, the NA’s Financial and Budget Committee noted that these vehicles already benefit from lower special consumption tax rates compared to other automobiles. However, given their 25-year lifespan, imposing the proposed tax rate could significantly impact businesses. The committee therefore suggested postponing the tax by one to two years or implementing a phased approach to give businesses time to adjust their production and operations.

Mr. Phan Van Mai also noted that some lawmakers called for the Government to clarify its stance on allowing or prohibiting the import, production, and sale of new-generation tobacco products in the draft law.

"The NA’s Resolution No.173/2024/QH15 already bans the production, sale, import, storage, transport, and use of e-cigarettes and heated tobacco products. Based on feedback from deputies, the NA’s Financial and Budget Committee recommends removing Article 12 from the draft law. However, the drafting committee suggests retaining it to establish a legal framework in case new tobacco products are permitted for import, production, and sale in the future," the Chairman of the NA's Finance and Budget Committee explained.

Contributing to the draft law’s finalization, Permanent Vice Chairwoman of the People's Aspirations and Supervision Committee Le Thi Nga reiterated her recommendation to exclude gasoline from the special consumption tax. “This issue has not been addressed, nor has there been a convincing explanation,” she said. She also argued that air conditioners are essential goods and should not be subject to special consumption tax. If they remain taxable, she emphasized that a clear justification is needed.

Chairman of the Committee on Legal Affairs Hoang Thanh Tung shared this view, noting that gasoline is a key input for the economy and is already subject to environmental protection tax. He also pointed out that air conditioners have become a necessity for most households and should not be taxed under special consumption tax.

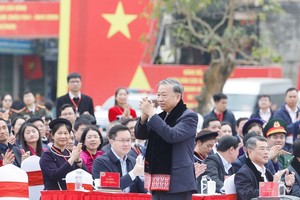

“Amendments should facilitate economic development rather than create additional constraints. The drafting process must be thorough and cautious before the proposal is submitted to the NA,” NA Chairman Tran Thanh Man emphasized.

In response, Deputy Minister of Finance Cao Anh Tuan stated that, following feedback from the Standing Committee of the NA, the Government would develop a tax guidebook to streamline special consumption tax implementation. However, he maintained that both gasoline and air conditioners should remain subject to special consumption tax.

“Even the latest air-conditioning technologies still use refrigerants that harm the environment, and many countries have regulations to limit their use. In Switzerland, for instance, obtaining a permit for air conditioner use is not simple. As for gasoline, Vietnam has applied special consumption tax since 1995, and the policy has remained stable,” Mr. Cao Anh Tuan explained.

)