On August 8, the VN-Index briefly rose over 10 points but closed down nearly 8 points. The market initially surged due to a rebound in real estate, construction, and public investment stocks, with some public investment stocks even hitting the ceiling.

However, news spread that TCH shares of Hoang Huy Investment Financial Services JSC were under investigation by the State Securities Commission for securities transactions during 2021-2022, causing the stock to hit the floor.

This immediately impacted other stocks in the same group, leading to a reversal and decline, with several stocks losing their gains, and some even falling below the reference price.

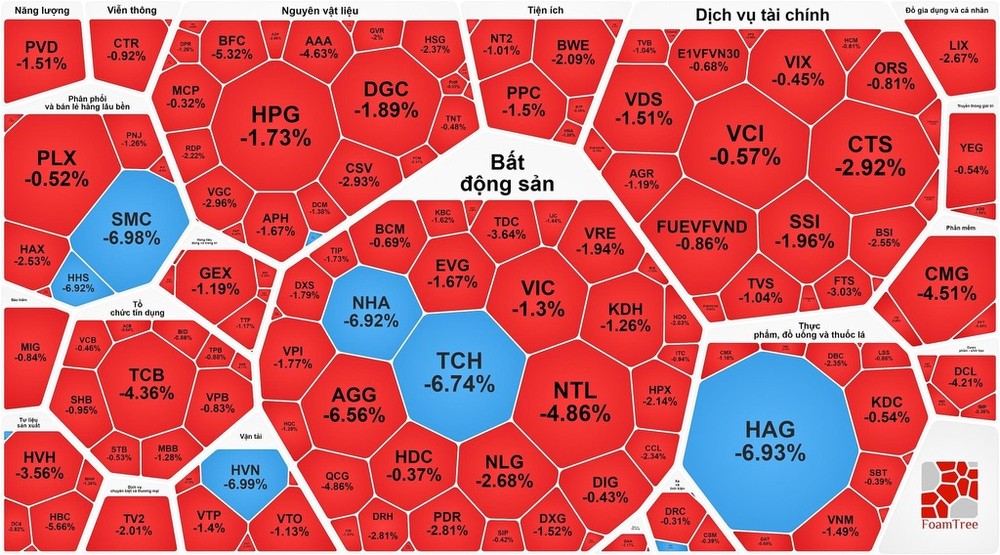

At the end of the session, most construction and real estate stocks were in the red. TCH hit the floor, dropping to VND16,600 per share, with over 12.8 million shares queued for sale at the floor price.

Other stocks in the real estate and construction sector also declined. Specifically, NHA hit the floor, HDG fell by 2.83 percent, VRE dropped by 1.94 percent, PDR decreased by 2.81 percent, KBC lost 1.62 percent, NLG was down 2.68 percent, NTL declined by 4.86 percent, and CEO retreated by 2.11 percent.

Despite being net sold by foreign investors, VHM still managed to rise 1.08 percent by the close. VCG, although no longer at its ceiling price, ended the session up by 5.7 percent, and FCN climbed by 4.7 percent. Some other stocks remained in the green, including LCG, which gained 5.8 percent, BCG advanced 1.41 percent, and CII rallied 1.4 percent.

Banking stocks continued to decline across the board, with TCB reducing 4.36 percent, MBB falling 1.28 percent, and EIB, VPB, SHB, ACB, MSB, VCB, TPB, and BID each slipping nearly 1 percent. The securities sector also saw widespread losses. SSI weakened by 1.96 percent, CTS evaporated by 2.92 percent, MSB slashed by 3.09 percent, BVS declined by 2.27 percent, and BSI cut by 2.55 percent.

HAG shares of Hoang Anh Gia Lai were heavily sold, dropping to the floor price of VND6,930 per share, with nearly 3.97 million shares queued for sale. Earlier, on August 5, Ms. Ho Thi Kim Chi, Deputy General Director of Hoang Anh Gia Lai, registered to buy 200,000 HAG shares through order matching on the exchange to increase her ownership to 595,159 shares, equivalent to 0.06 percent. The trading period runs from August 8 to September 6.

Additionally, HVN shares of Vietnam Airlines hit the floor, dropping to VND19,950 per share.

In terms of sector performance, only the electricity-gas, retail, and industrial services sectors saw gains, with GAS escalating 2.9 percent, CHP rising 1.6 percent, and POW, REE, and VSH going up nearly 1 percent. PET gained 1.18 percent, and both MWG and FRT emerged by nearly 1 percent; PVT won 2.01 percent; GMD, HAH, and VSC also edged up nearly 1 percent.

The VN-Index fell 7.56 points, or 0.62 percent, to close at 1,208.32 points, with 257 declining stocks, 161 advancing stocks, and 62 unchanged. On the Hanoi Stock Exchange, the HNX-Index also dropped 1.22 points, or 0.54 percent, to 226.73 points, with 82 losers, 63 winners, and 56 unchanged stocks. Liquidity increased due to strong selling pressure at the end of the session, with the total trading value on HOSE exceeding VND16.7 trillion, up VND2.5 trillion from the previous session.

Foreign investors extended their net selling streak on HOSE for the fourth consecutive session, with a substantial net selling value of nearly VND1.162 trillion. VHM was the most heavily sold stock, with net sales of VND316 billion, followed by TCB with nearly VND214 billion, HPG with around VND137 billion, VPB with about VND73 billion, and SSI with approximately VND62 billion.