After a steep decline in the previous session, the stock market still faced heavy selling pressure from domestic investors on April 4 although foreign investors halted their selling activities. The market was awash in red, with declining stocks outnumbering advancers. Although there were moments during the session when the VN-Index briefly turned green, primarily supported by large-cap stocks such as VNM, VCB, and VIC, the index ultimately closed in the red.

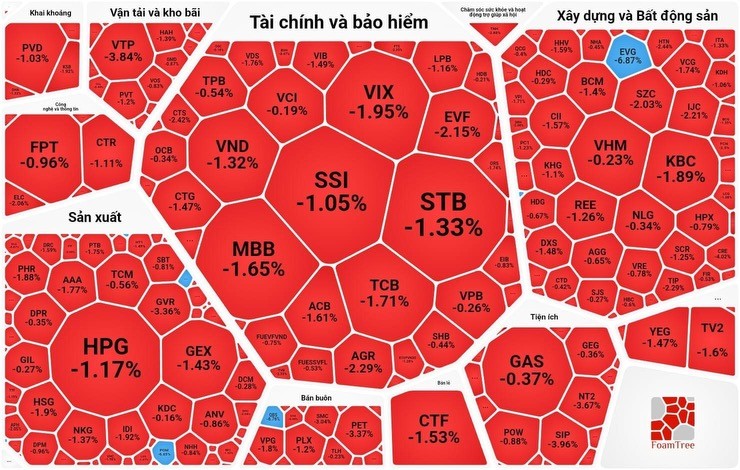

Except for VCB which surged by 2.35 percent, banking stocks endured sharp declines. Specifically, MBB plummeted by 1.65 percent, STB sank by 1.33 percent, TCB dropped by 1.71 percent, CTG fell by 1.47 percent, ACB slid by 1.61 percent, and VIB decreased by 1.49 percent. Securities stocks also witnessed significant drops. FTS plunged by 2.35 percent, AGR slumped by 2.29 percent, SSI dipped by 1.05 percent, VIX dived by 1.95 percent, VND slipped by 1.32 percent, ORS retreated by 1.74 percent, and SHS lost by 1.92 percent.

Within the real estate and construction sector, some stocks rose robustly. TCH surged by 4.78 percent, DPG soared by 6.52 percent, NTL climbed by 3.96 percent, NVL advanced by 1.74 percent, DIG rose by 1.26 percent, and VIC, DXG, and PDR edged up by almost 1 percent. However, many stocks in this sector declined by over 1 percent. FCN slashed by 2.5 percent, CEO reduced by 1.27 percent, HUT declined by 1.55 percent, AZC cut by 2.03 percent, KBC fell by 1.89 percent, CII receded by 1.57 percent, VCG collapsed by 1.74 percent, KDH went down by 1.06 percent.

Some stocks in the manufacturing sector managed to sustain gains. VNM rallied by 2.25 percent, DBC emerged by 1.41 percent, and SAB, PAN, BAF, and DGC added up by nearly 1 percent. Additionally, retail stocks performed positively with MWG rising by 1 percent, and PNJ and FRT increasing by almost 1 percent.

At the end of the trading session, the VN-Index declined by 3.22 points, or 0.25 percent, to reach 1,268.25 points. Of the index, 379 stocks dropped, 110 climbed, and 62 stood still.

Closing at the Hanoi Stock Exchange, the HNX-Index also saw a decrease of 1.52 points, or 0.62 percent, settling at 242.44 points, with 101 stocks declining, 61 advancing, and 73 maintaining their previous levels.

Market liquidity dwindled, with the total trading value on the HOSE reaching approximately VND23.9 trillion, down VND4.5 trillion from the previous session.