|

Following a robust trading session the day before, the VN-Index retreated to a consolidating stance by the week's end within the range of 1,177 to 1,200 points. Although liquidity displayed improvement, both pricing and trading volume witnessed a reduction. Additionally, foreign investors shifted to net selling, tallying an amount close to VND850 billion on the HOSE.

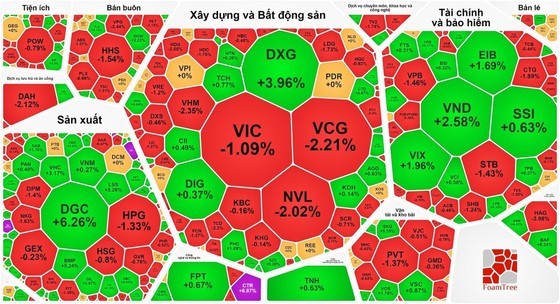

During the trading session on August 25, the Vietnamese stock market remained under notable selling pressure, leading to an immediate decline in the VN-Index from the session's start. However, the securities sector persevered in sustaining its upward trajectory in this trading session. Notably, VND saw a rise of 2.58 percent, VIX increased by 1.96 percent, SSI climbed by 0.63 percent, VCI advanced by 0.58 percent, HCM edged up by 0.5 percent, FTS gained 0.31 percent, and BSI recorded an increase of 0.32 percent.

Furthermore, the seafood stocks category experienced a notable surge in value driven by reports of China's embargo on seafood imports from Japan. Consequently, IDI reached its upper trading limit, VHC rallied by 3.17 percent, ANV jumped by 4.79 percent, and FMC registered a gain of 2.15 percent.

The real estate sector displayed significant divergence, as large-cap stocks recorded declines, including VCG dropping by 2.21 percent, NVL falling by 2.01 percent, VIC dropping by 1.09 percent, VHM sliding by 2.35 percent, BCM going down by 0.75 percent, and VRE reducing by 1.2 percent. In contrast, small and mid-sized stock categories performed positively, with significant gains seen in stocks like SJS (6.1 percent), DGC (6.26 percent), and DXG (3.96 percent).

Likewise, within the banking sector, most of the blue-chip stocks also witnessed declines. For instance, BID dropped by 1.31 percent, STB weakened by 1.43 percent, CTG cut by 1.89 percent, and VPB retreated by 1.46 percent, while VCB, TCB, MBB, ACB, SSB, and VIB all saw a reduction of nearly 1 percent. On the other hand, stocks of medium and small scale posted gains, with EIB rising by 1.69 percent, BVB enhancing by 1 percent, and ABB growing by 1.2 percent.

Following the previous net buying session, foreign investors continued to be net sellers in this session, tallying a net selling value of nearly VND850 billion on the HOSE.

As the trading session concluded, the VN-Index declined by 6.02 points, or 0.51 percent, settling at 1,183.37 points. The market saw 331 stocks in decline, 173 in advancement, and 70 stocks maintaining their previous levels.

On the Hanoi Stock Exchange, the HNX-Index also recorded a marginal drop of 0.33 points, or 0.14 percent, with 97 losers, 82 winners, and 64 unchanged stocks. Liquidity improved, as the total trading value across the market reached nearly VND22.9 trillion, compared to the previous day's level of VND24.4 trillion.